Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

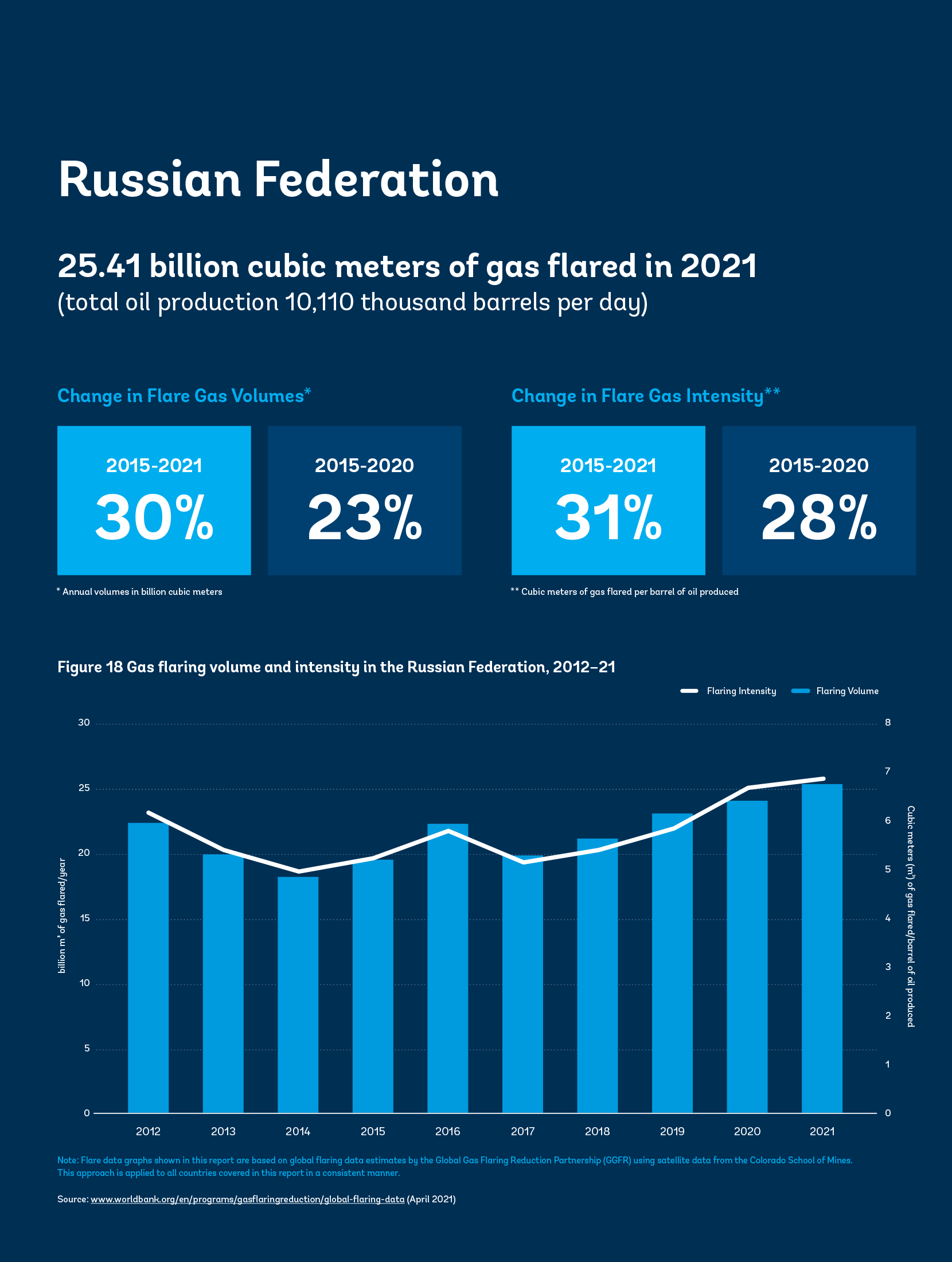

The Russian Federation was the world’s largest contributor by volume to gas flaring in 2021. The traditional oil-producing regions of West and East Siberia, as well as the Khanty-Mansiysk Autonomous Okrug district, have been the key contributors. The flaring intensity has been increasing since 2017, reaching the highest level since 2012 in 2021. There were 1,086 individual flare sites in the last flare count, conducted in 2019.

Gas flaring volume and intensity in the Russian Federation, 2012–21

Russia endorsed the World Bank’s Zero Routine Flaring by 2030 initiative in 2016 (World Bank, n.d.); two of its major national oil companies, Gazprom and Lukoil, did so in 2017. Russia also participates in the Global Methane Initiative (n.d.) and the Climate and Clean Air Coalition (n.d.0). Russia’s first NDC, submitted to the UNFCCC in November 2020, targets a reduction in GHG emissions to 70 percent of the 1990 level but does not mention gas flaring and venting.

Starting in 2007, with the President’s State of the Nation Address, increasing the efficient use of associated gas and reducing flaring became national priorities. One of the targets of the Energy Strategy for Russia for the Period Up to 2030 (Ministry of Energy of the Russian Federation 2010) is the utilization of 95 percent of associated gas. To help achieve it, Russia passed, key legislation, with amendments introducing a mix of fees and commercial incentives. Examples include Federal Decree No. 1148, 2012, and the Federal Law on Environmental Protection, 2001. Early progress was made—such as replacing diesel with associated gas in electricity generation in the Yuzhno-Priobskoye oil field—but the initial success did not last long and was soon followed by rising levels of flaring and venting.

Federal Law No. 296 FZ on Limiting Greenhouse Gas Emissions, 2021 requires high emitters (those above 150,000 tCO2 by 2023 and above 50,000 tCO2 by 2024) to comply with carbon reporting requirements, which have not yet been fully defined. The stated purpose of this new legislation is to “create conditions for sustainable and balanced development of the economy.” As such, it is in line with the general trend toward decarbonization of the oil and gas value chain.

Targets and Limits

Federal Decree No. 1148, 2012, limits flaring or venting to 5 percent of the total volume of associated gas produced. This target was first mentioned in the Energy Strategy for Russia for the Period up to 2030 (approved by Federal Decree No. 1715-r, 2009).

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

Federal Law No. 2395-1 on Subsoil, 1992, is the central piece of legislation for the use of subsurface resources and related matters (Article 1). Article 23 requires rational use of subsurface resources.

Article 1 of Federal Law No. 7-FZ on Environmental Protection, 2001, states that one of its overarching goals is to prevent adverse impacts on the natural environment from economic or other activities. Article 16 states that fees will be levied for the emission of pollutants and specifies the procedures for calculating the fees for gas flaring and venting.

Federal Decree No. 1148, 2012 defines the formulas applicable to calculate the fees for flaring and venting (Sections 3 and 10). Federal Decree No. 913, 2016, defines the inputs per emission pollutant (Appendix 1) and other environmental factors (Appendix 2) to be used in the calculation formula for the fee. Federal Decree No. 255, 2017, establishes the payment process for these fees (Sections 1 and 4).

Articles 1 and 4 of Federal Law No. 69-FZ on Gas Supply, 1999, require the rational use of gas. They are intended to ensure that the country’s need for energy resources is met. Article 27, in combination with the amendments in Federal Law No. 241-FZ, 2012, requires owners and operators of transmission and distribution facilities to give preferential access to free capacities in the “Unified Gas Supply System” to associated gas. Federal Law No. 35-FZ on the Electric Power Industry, 2003, gives electricity produced from associated gas priority access to the wholesale market, second only to the electricity produced from system securing capacity. Federal Law No. 225-FZ on Production Sharing Agreements, 1995, links renewals of PSCs to the rational use of subsurface resources.

Legislative Jurisdictions

Gas flaring and venting are matters of federal jurisdiction. However, Article 1 of Federal Law No. 2395-1 on Subsoil, 1992, grants local governments the right to further regulate flaring and venting within the limits of the relevant federal laws.

Associated Gas Ownership

Article 1 of Federal Law No. 2395-1 on Subsoil, 1992, states that subsurface natural resources in Russia are property of the state. In line with the principles applicable to concession systems, title to resources once extracted is transferred to the producer. Based on the requirement to pay an emission pollution fee, as stated in Federal Law No. 7-FZ on Environmental Protection, 2001, and the related federal decrees, ownership of associated gas remains with the producer. In a limited number of instances, PSCs have been concluded. According to Article 9 of the Federal Law No. 225-FZ on Production Sharing Agreements, 1995, title to a part of the production is transferred to the contractor under the terms of the PSC.

Regulatory Governance and Organization

Regulatory Authority

Overall responsibility for overseeing subsoil resources, including policies for flaring and venting of associated gas, lies with the Federal Ministry of Natural Resources and the Environment. Federal Law No. 7-FZ on Environmental Protection, 2001 established a specialized authority. This law assigns responsibility for oversight of compliance with energy regulation to the Federal Service for Supervision of Natural Resources. Article 3 of Federal Law No. 2395-1 on Subsoil, 1992 establishes the Federal Agency for Mineral Resources as the central administrative agency for subsurface resources. It has no direct responsibilities regarding flaring and venting.

Regulatory Mandates and Responsibilities

In line with the clear separation between policy making, regulatory and compliance monitoring, and service provision, federal ministries make policies and issue regulations. As part of its overall responsibility to oversee subsoil usage, the Federal Ministry of Natural Resources and the Environment has issued associated gas regulation for flaring and venting in its regulatory capacity.

Federal services are executive authorities vested with permitting, inspection, and administrative enforcement functions. Federal agencies provide public services, manage state property, and maintain various types of registers. Flaring-specific responsibilities are covered in Federal Law No. 7-FZ on Environmental Protection, 2001, which entrusts the Federal Service for Supervision of Natural Resources with execution of those responsibilities. Section 4 of Federal Decree No. 255, 2017 assigns responsibility for calculating and collecting fees for pollutant emissions to this federal service. However, because of its authority in assessing the adequacy of the metering systems and establishing accounting procedures for associated gas, the Federal Ministry of Energy can indirectly influence the level of fees paid for flaring and venting (see the Engineering Estimates, and Monetary Penalties sections of this case study).

Monitoring and Enforcement

Federal Law No. 7-FZ on Environmental Protection, 2001, in combination with Federal Decree No. 1148, 2012, assigns monitoring and enforcement powers to the Federal Service for Supervision of Natural Resources (see the Primary and Secondary Legislation and Regulation, Regulatory Authority, and Regulatory Mandates and Responsibilities sections of this case study).

Licensing/Process Approval

Flaring or Venting without Prior Approval

No evidence regarding flaring or venting without prior approval could be found in the sources consulted.

Authorized Flaring or Venting

Federal Law No. 7-FZ on Environmental Protection, 2001 requires that an environmental impact declaration (Article 31) and an EIA (Article 32) be carried out on economic or other activities that may directly or indirectly affect the environment.

Development Plans

Article 46 of Federal Law No. 7-FZ on Environmental Protection, 2001 requires oil and gas facilities to be designed and operated in a manner that is not harmful to the environment. Article 3 of Federal Law No. 2395-1 on Subsoil, 1992 gives the Federal Agency for Mineral Resources the powers to review and approve development plans and PSCs. These powers allow the agency to influence the use of associated gas in future oil production.

Economic Evaluation

No evidence regarding economic evaluations could be found in the sources consulted.

Measurement and Reporting

Measurement and Reporting Requirements

Article 22 of Federal Law No. 2395-1 on Subsoil, 1992 requires the oil and gas producer to submit to the Federal Geological Information Fund reliable information on volumes explored and produced. To ensure the uniformity of measurements, meters must meet the metrological and technical requirements as defined by a normative guideline issued by the Federal Ministry of Energy. Section 3 of Federal Decree No. 1148, 2012 requires oil producers to report their “flaring rate”—the percentage of associated gas that is flared and vented (see the Monetary Penalties section of this case study).

Measurement Frequency and Methods

Section 3 of Federal Decree No. 1148, 2012, requires oil producers to report the flaring rate quarterly. Reporting requirements for well data other than flaring and venting can be more frequent.

Engineering Estimates

There is no mention of acceptable alternatives to metering. Section 5 of Federal Decree No. 1148, 2012, increases the fee for flaring and venting if no metering system is in place or the system used does not meet the Federal Ministry of Energy’s requirements.

Record Keeping

Operators must maintain measurement instrument readings and other technical equipment records, but there is no specific mention of flaring and venting.

Data Compilation and Publishing

No evidence regarding data compilation and publishing could be found in the sources consulted.

Fines, Penalties, and Sanctions

Monetary Penalties

Article 16 of Federal Law No. 7-FZ on Environmental Protection, 2001 specifies the procedures for calculating associated gas flaring or venting fees. Sections 1– 7 of Federal Decree No. 1148, 2012 defines the key principles applicable to calculating these fees:

- The maximum admissible limit value for flaring and venting combined should be no more than 5 percent of the total associated gas volume, calculated by the flaring rate (Z),

- Z = S/V x 100%,

- where S is the amount of associated gas flared and vented and V is the volume of associated gas produced. Volumes flared during scheduled shutdowns are excluded from the calculations.

- Below the maximum admissible limit value, the fee calculation (using emission pollutants and environmental factors) as quoted in Federal Decree No. 913, 2016 applies without any additional multiplier uplift.

- Above the maximum admissible limit value, a multiplier (k-factor) of 25 applies to the calculated fee, up from the previous k-factor of 12, which was applicable until 2014.

- An additional k-factor of 120 applies if there is no metering system that meets the Federal Ministry of Energy requirements in place.

- Efforts to increase associated gas use are captured in a cost coverage indicator, which reduces the overall fee.

Production of less than 5 million m3 a year and production with a hydrocarbon saturation of less than 50 percent can be exempt from additional fees.

Federal Decree No. 255, 2017 requires these fees to be paid in quarterly advance payments (except for the fourth quarter). Sections 1 and 3 empower the Federal Service for Supervision of Natural Resources to verify the fee calculations and collect the fees, which are not tax-deductible.

Nonmonetary Penalties

Article 20 of Federal Law No. 2395-1 on Subsoil, 1992 allows the Federal Agency for Mineral Resources to terminate upstream licenses if established or license-specific rules are violated. Federal Law No. 225-FZ on Production Sharing Agreements, 1995 links PSC renewal to the rational use of subsurface resources (Article 5) and allows for early termination of PSCs in case of noncompliance with federal legislation (Article 21).

Enabling Framework

Performance Requirements

No evidence regarding performance requirements could be found in the sources consulted.

Fiscal and Emission Reduction Incentives

Fees related to gas flaring and venting are not tax-deductible. However, legal entities participating in several oil and gas projects across the value chain could benefit from fiscal consolidation, allowing them to offset profits from one project against losses from another. Depending on how profitable the other operations are, doing so could enable the utilization of associated gas, which would otherwise be flared or vented.

Use of Market-Based Principles

No evidence regarding the use of market-based principles to reduce flaring, venting, or associated emissions could be found in the sources consulted.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

Interplay with Midstream and Downstream Regulatory Framework

Article 27 of Federal Law No. 69-FZ on Gas Supply, 1999 requires owners and operators of transmission and distribution facilities to give associated gas preferential access to free capacities. Article 32 of Federal Law No. 35-FZ on the Electric Power Industry, 2003 gives electricity produced from associated gas preferential access to the wholesale market.