Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

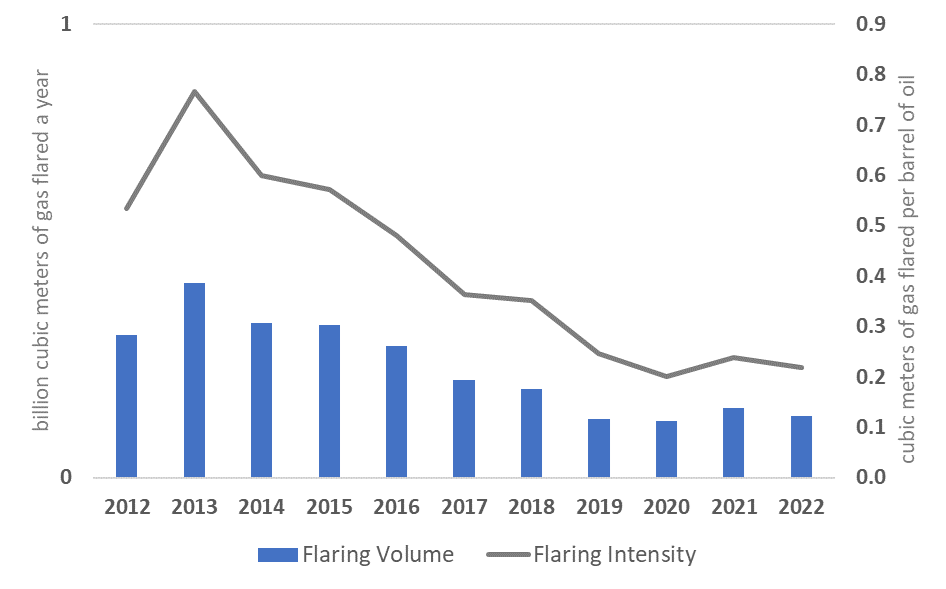

Norway has Europe’s largest hydrocarbon reserves and is among the 15 largest producers of oil globally. It recorded the lowest flaring intensity of all countries under review every year between 2012 and 2022. Norway produced about the same amount of oil in 2021 as Kazakhstan, and Mexico, but these countries flared 7–42 times the volume flared in Norway. Between 2012 and 2022, oil production rose slightly in Norway, but both the volume of gas flared and the flaring intensity continued their decline (Figure 9). There were just 31 individual flare sites in the most recent flare count, conducted in 2022.

Figure 9 Gas flaring volume and intensity in Norway, 2012–22

Equinor ASA (a Norwegian majority state-owned energy company) endorsed the World Bank’s Zero Routine Flaring by 2030 initiative in 2015, followed by the endorsement by the government of Norway in 2016. Norway also participates in the Global Methane Initiative, the Global Methane Pledge, and the Climate and Clean Air Coalition, to which Norway submitted its National Methane Action Plan in November 2022. More than half of current methane emissions are from the agriculture sector, followed by the waste and energy sectors, which emit roughly equal shares. Between 1990 and 2020, methane emissions declined about 24 percent, mostly thanks to improvements in the waste sector. Norway does not have specific targets for methane emissions but they are included in the Nationally Determined Contribution (NDC) targets for all greenhouse gases (GHGs).

Norway submitted its first NDC to the United Nations Framework Convention on Climate Change in June 2016, its first update in February 2020, and its second update in November 2022. In each submission, Norway increased the target for reducing economywide GHG emissions from the 1990 level—by 40 percent in 2016, at least 50 percent in 2020, and at least 55 percent in 2022.

Environmental and climate considerations are an integral part of Norway’s petroleum industry policies, which include higher local and global environmental standards than those seen in most other oil- and gas-producing countries. Norway has imposed restrictions on flaring and venting since oil production began in the early 1970s. In 1971, the government adopted the so-called 10 Oil Commandment principles for oil-related policies. The fifth commandment prohibits gas flaring on the Norwegian continental shelf except during brief periods of testing and for safety-related reasons.

The government’s Environmental Policy and the State of the Environment, 2000–2001, prohibited gas flaring and venting to avoid wasting energy. Operators are required to have a solution in place for gas, and the Norwegian authorities must approve any flaring and venting for operational safety. Norwegian environmental policy has historically been based on direct regulation of environmentally harmful emissions and discharges. The CO2 Tax Act, or Act No. 72 Relating to Tax on the Discharge of CO2 in the Petroleum Activities on the Continental Shelf, 1990 (the CO2 Tax Act, 1990, hereafter) and the emissions cap system have had a significant impact on reducing emissions. Norway aims to reduce GHG emissions to near zero by 2050, as outlined in Equinor’s 2020 Sustainability Report and the Act Relating to Norway’s Climate Targets, 2018 (the Climate Change Act, 2018, hereafter).

Targets and Limits

No evidence regarding targets and limits could be found in the sources consulted.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

Act No. 72 Relating to Petroleum Activities,1996, or the Norwegian Petroleum Act, 1996, prohibits gas flaring in excess of the quantities needed for operational safety unless approved by the Norwegian Petroleum Directorate (NPD). The Regulations to Act Relating to Petroleum Activities, 1997 (last amended in December 2022), provide further details on the permit application process and the reporting of flare and vent volumes (see sections 10 and 13 of this case study). The Measurement Regulations, or the Regulations Relating to Measurement of Petroleum for Fiscal Purposes and for Calculation of CO2-tax, 2001, detail how to measure and report flare and gas volumes.

The NPD publishes guidelines to help with the compliance of these regulations. They cover the following:

- application for a production permit, including flaring and cold venting permits

- fiscal measurement of oil and gas

- plan for development and operations of petroleum activities

- standards relating to the measurement of petroleum.

Section 2 of the CO2 Tax Act, 1990 , imposes a carbon dioxide tax on flared or vented gas and carbon dioxide separated from petroleum and discharged into the air at installations used to produce or transport petroleum. The Climate Change Act, 2018 , supports the implementation of Norway’s climate policy of moving to a low-emission society by 2050. The law also aims to promote a transparent and public debate on the status, direction, and progress of efforts toward that end.

Act No. 6 Concerning Protection against Pollution and Concerning Waste, 1981 (the Pollution Control Act, 1981, hereafter), is intended to protect the environment from pollution, reduce existing pollution, reduce the quantity of waste, and promote better waste management. It aims to ensure that pollution and waste do not damage human health or affect the welfare of, or damage, the natural environment’s productivity and self-renewal capacity.

Legislative Jurisdictions

Flaring and venting are matters of national jurisdiction, per Section 1 of the Norwegian Petroleum Act, 1996.

Associated Gas Ownership

Section 3 of the Norwegian Petroleum Act, 1996 states that the licensee obtains title to all oil and gas produced. As a result, the licensee owns all gas that is flared or vented. This ownership allocation is consistent with the CO2 Tax Act, 1990 , Section 4 of which requires the licensees to pay the CO2 tax.

Regulatory Governance and Organization

Regulatory Authority

The NPD under the Ministry of Petroleum Energy (MPE) is the key institution in charge of policy, regulation, and enforcement of gas flaring and venting. The Norwegian Ministry of Climate and Environment develops integrated climate and environmental policies. Its subordinated agency, the Norwegian Environment Agency, is the environmental regulator.

Regulatory Mandates and Responsibilities

The NPD is responsible for general resource management considerations, including reducing emissions from oil and gas activities to the air and the sea through cost-effective measures. It monitors and collects data on the volumes of gas flared, as outlined in the Regulations Relating to Resource Management in the Petroleum Activities, 2018. The Norwegian Environment Agency is responsible for implementing the Pollution Control Act, 1981 . The Norwegian Environment Agency’s overall responsibilities cover managing Norway’s natural assets and preventing pollution. These responsibilities also entail areas relevant to flaring and venting, such as the promotion of clean air and a toxic-free environment and the reduction of noise pollution.

Monitoring and Enforcement

Section 81 of the Regulations to Act Relating to Petroleum Activities, 1997 , authorizes representatives from the MPE, the NPD, or other authorities as decided by the NPD to access vessels and facilities for inspection of petroleum activities. They may also access all existing data and materials necessary to perform regulatory supervision, and they have the right to participate in survey activities. Representatives from the authorities have the right to stay on vessels and facilities for as long as necessary.

Licensing/Process Approval

Flaring or Venting without Prior Approval

Section 9 of the Norwegian Petroleum Act, 1996 , requires oil and gas operations to be conducted in such a manner as to maintain a high level of safety. Section 4-4 of the law allows operators to flare associated gas in the quantities needed for operational safety. Section 2 (General Factors) of the Guidelines for Production Permit Applications (last updated in spring 2023; see footnote 13) suggests that cold venting for safety reasons for normal operations is also allowed.

Authorized Flaring or Venting

Section 23 of the Regulations to Act Relating to Petroleum Activities, 1997 , requires the operator to apply to the MPE to flare or vent gas, with a copy of the application submitted to the NPD. Permits are issued for a period of one calendar year according to the Guidelines for Production Permit Applications. Upon application, the MPE specifies the quantity that may be produced, injected, or vented for fixed periods of time according to Section 4-4 of the Norwegian Petroleum Act, 1996 . The NPD ensures compliance with these quantities. Venting is usually allowed for safety reasons, start-up, or testing.

Development Plans

Section 4-2 of the Norwegian Petroleum Act, 1996 , requires the submission of a field development plan to the MPE for approval. The plan should cover all dimensions, including economic, reservoir, technical, safety, and environmental and decommissioning aspects. These requirements are detailed in Section 21 of the supporting regulations, Regulations to Act Relating to Petroleum Activities, 1997 . The plan for development and operation should include a description of technical solutions and cover means of preventing and minimizing environmentally harmful discharges and emissions, such as flaring and venting. The development plan should also include information on approvals or consents that have been applied for, including flaring and venting authorizations.

Economic Evaluation

Section 4 of the Norwegian Petroleum Act, 1996 , requires oil and gas to be produced according to prudent technical and sound economic principles that mitigate the waste of petroleum resources. Toward that end, the licensee should continuously evaluate the production strategy and technical approach being used and adjust these as needed. Facts 2012– the Norwegian Petroleum Sector, 2012, illustrates several projects implementing opportunities to minimize gas flaring and venting. An example is the Goliat Project, centered on an oil and gas field located in the Barents Sea. The discovery well was drilled in 2000, and the field went into production in 2016. Associated gas has been re-injected or transported through a pipeline to Melkøya.

Measurement and Reporting

Measurement and Reporting Requirements

Section 48 of the Regulations to Act Relating to Petroleum Activities, 1997 , requires the operator to submit information to the NPD on the use, injection, flaring, and venting of natural gas. Such information should be based on metering as much as possible. The Measurement Regulations, 2001 , stipulate functional and compliance requirements, including reporting and documentation, related to the planning, design, construction, and operation of metering systems and equipment to measure and report the quantities of gas flared or vented in petroleum activities. The NPD approves the equipment and procedures. Section 29 of the Measurement Regulations, 2001, requires the reporting of carbon dioxide tax metering to support the payment of the carbon dioxide tax every six months (calculated per field or facility).

Section 3 of the Comments to Regulations Relating to Measurement of Petroleum for Fiscal Purposes and for Calculation of CO2 Tax, 2018, holds the operator of each individual field or facility directly responsible for the duties placed with the licensees jointly pursuant to the Norwegian Petroleum Act, 1996 , and the CO2 Tax Act, 1990 . Such duties include the design, purchase, and operation of metering systems, associated reporting, and payment of tax. The CO2 Tax Act, 1990, authorizes the Ministry of Finance to issue additional provisions for the carbon dioxide tax and equipment requirements for metering, measurement methods, and documentation.

Measurement Frequency and Methods

Operating companies that hold flaring permits must submit a report to the MPE indicating the amount of gas flared daily. Section 8 of the Measurement Regulations, 2001 , sets the uncertainty limit at 5 percent by volume for flared or vented gas and lists uncertainty and repeatability limits for several types of measuring instruments. According to Section 11, gas composition is determined from continuous flow proportional gas chromatography or from automatic flow proportional sampling.

Engineering Estimates

Section 29 of the Measurement Regulations, 2001, requires documentation of engineering estimates in lieu of measurement where measurement was not undertaken for technical reasons.

Record Keeping

Operators are responsible for keeping an emissions inventory, which they are required to submit to the NPD annually. According to Chapter 4 of Act No. 99 Relating to Greenhouse Gas Emission Allowance Trading and the Duty to Surrender Emission Allowances, 2004, operators must submit a report on GHG emissions in a given calendar year to the pollution control authorities by March 1 of the following year. No information could be found in the sources consulted regarding how long records are to be kept.

Data Compilation and Publishing

Emissions from the oil and gas sector in Norway are well documented. The MPE publishes data on its website. The Norwegian Oil and Gas Association, an industry organization, has established a national database for reporting all releases from the industry, called the EPIM Environment Hub. All operators report data on emissions to air and discharges to the sea directly in the EPIM Environmental Hub. The data are published in some of the Resource Reports of the NPD. The latest report with emissions data is from 2019. Statistics Norway publishes statistics on air pollution from activities, including oil and gas extraction.

Fines, Penalties, and Sanctions

Monetary Penalties

According to Section 10 of the Norwegian Petroleum Act, 1996 , noncompliance with an order issued pursuant to the law may result in a daily fine for each day of the violation. Section 10 subjects a willful or negligent violation to fines or imprisonment. As the Norwegian Petroleum Act, 1996, prohibits flaring in excess of what is needed for safe operations, these fines apply to such excessive flaring. Separately, a carbon tax is imposed on all gas flared or vented, and willful or negligent submission of incorrect or incomplete documentation or any other breach of provisions or decisions contained in or issued by virtue of the CO2 Tax Act, 1990 , is subject to a fine.

Nonmonetary Penalties

Section 10 of the Norwegian Petroleum Act, 1996 , imposes nonmonetary penalties, including the temporary suspension of activities, license revocation, and imprisonment of as long as two years for a willful or negligent violation. Willful or negligent submission of incorrect or incomplete documentation or any other breach of provisions or decisions contained in or issued by virtue of the CO2 Tax Act, 1990 , may result in imprisonment of up to three months.

Enabling Framework

Performance Requirements

No evidence regarding performance requirements could be found in the sources consulted.

Fiscal and Emission Reduction Incentives

The main instruments for restricting GHG emissions—emissions trading and the carbon dioxide tax— are economic; they provide financial incentives to minimize emissions. Norway was one of the first countries in the world to introduce a carbon tax, in 1990. Sections 1, 2, and 4 of the CO2 Tax Act, 1990 , require a carbon dioxide tax payment for flared or vented natural gas and any other carbon dioxide discharged to the atmosphere during the production and transport of oil and gas unless otherwise exempted by the Storting (Parliament). The operator calculates, reports, and pays the total tax amount to the NPD on behalf of all other licensees. The operator provides the NPD with the documentation for metering petroleum and calculating the tax within a month of the expiry of each term. If the tax is not paid on time, it accrues interest. According to Section 3 of the CO2 Tax Act, 1990, the carbon dioxide tax is not deductible from the calculation of the production fee (defined in Section 4 of the Norwegian Petroleum Act, 1996 . According to Norway’s Climate Action Plan, the government may consider the introduction of a tax on methane emissions from onshore petroleum facilities, corresponding to the tax that already applies to offshore activities.

For 2023, the tax rate is proposed at NKr 1.78 (about US$0.16 as of June 2023) per cubic meter (m3) of gas or per liter of oil or condensate. For emissions of natural gas, the tax rate is NKr 13.67 (about US$1.24 as of June 2023) per m3. For combustion of natural gas, the rate is equivalent to NKr 761 (about US$69 as of June 2023) per tonne of carbon dioxide (tCO2). The companies also pay European Union Emissions Trading System (EU ETS) allowance costs. The Norwegian government proposes to gradually raise the total cost of carbon (the Norwegian carbon dioxide tax and the cost of EU ETS allowance) to NKr 2,000 (about US$181.4 as of June 2023) per tCO2e by 2030.

Use of Market-Based Principles

Carbon dioxide emissions from the oil and gas sector are covered under the EU ETS Act No. 99 Relating to Greenhouse Gas Emission Allowance Trading and the Duty to Surrender Emission Allowances, 2004 , which entered into force in 2005. Norway joined the EU ETS in 2008.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

Interplay with Midstream and Downstream Regulatory Framework

Section 59 of the Regulations to Act Relating to Petroleum Activities, 1997 , grants operators undertaking downstream natural gas activities and eligible customers the right to access pipeline networks. The access is subject to the quality of the gas being compatible with technical specifications or efficient operation of the pipeline network. The pipeline network operator may require additional conditions after consulting with existing users of the pipeline network.