Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

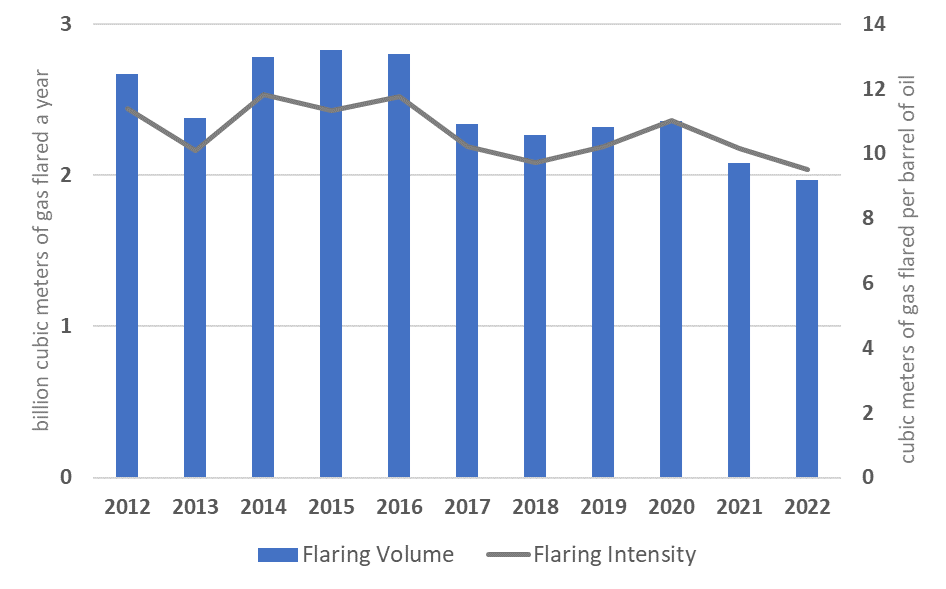

The volume of gas flared in the Arab Republic of Egypt averaged 2.7 billion cubic meters (bcm) in 2012, rose to 2.8 bcm in 2014–16, and fell to 2.0 bcm in 2022 (Figure 1). The flaring intensity did not vary much during the same period but shows a steady decline since 2020. There were 146 individual flare sites in the most recent flare count, conducted in 2022.

Figure 1. Gas flaring volume and intensity in Egypt, Arab Rep., 2012–22

While the country’s initial Nationally Determined Contribution (NDC), set in 2017, did not commit Egypt to greenhouse gas (GHG) mitigation targets, the updated NDC, submitted in June 2022, provides mitigation targets for three sectors: electricity, oil and gas, and transport. Relative to the business-as-usual scenarios, the GHG reductions by 2030 are targeted to be 33 percent, 65 percent, and 7 percent, respectively. The recovery and utilization of flared gas is listed as a distinct action but without specific targets. In 2017, the Egyptian government endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. Egypt also participates in the Global Methane Pledge.

According to Egypt’s First Biennial Update Report to the United Nations Framework Convention on Climate Change (UNFCCC), released in 2018, flaring and venting from oil and gas activities accounted for less than 3 percent of GHG emissions in the country. The report estimates that fuel combustion by industries such as power generation, transport, and refining accounted for 85 percent of all GHG emissions. These and other activities are grouped under the energy sector, which is collectively responsible for 87 percent of total GHG emissions. To date, GHG mitigation actions have focused primarily on the energy sector. They include the reform of energy subsidies, investment in wind and solar power generation, enhancement of energy efficiency, and replacement of higher-carbon fuels with natural gas or biomass. Egypt has also used the Clean Development Mechanism (CDM) of the UNFCCC.

The government has been promoting the use of natural gas and enacted a new law to open the gas sector to competition, regulated by a new regulator (see section 24 of this case study). These reforms and government efforts to increase gas use—which would reduce GHG emissions by substituting gas for fuels with greater GHG emissions intensity—may create incentives for operators to capture the associated gas they are currently flaring or venting, especially from new upstream projects.

Targets and Limits

No evidence regarding targets and limits could be found in the sources consulted. Production-sharing contracts (PSCs) call for avoiding the waste of petroleum resources but also for making sure that oil production is not impaired if associated gas cannot be utilized (see sections 3 and 9 of this case study). Based on data from the Egypt General Petroleum Company (EGPC), more than two-thirds of well sites have flaring rates of less than 1 million standard cubic feet (mmscf) a day. The Egyptian Environmental Affairs Agency (EEAA) may impose emissions limits in an environmental impact assessment (see section 7 of this case study), but no specific limits on emissions from flares or vents could be found in the sources consulted.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

The Environmental Protection Law 4, 1994 (amended by Law 9, 2009) and the implementing regulations cover emissions from combustion, including flaring (see sections 6 and 7 of this case study).

Concession agreements are granted for exploration. The three parties are:

- the government, as the owner of oil and gas

- a local private company or a foreign company

- one of three state-owned petroleum companies (“national companies” hereafter): EGPC, which directly or indirectly controls shares in dozens of joint ventures and privately held companies; Ganoub El Wadi Petroleum Holding, which oversees petroleum activities mainly in the southern region of Egypt; and the Egyptian Gas Holding Company (EGAS), which has been a party to all gas concession agreements since 2004.

If there is a commercial discovery of oil and gas, a PSC is negotiated, and a joint venture is established between the contractor and one of the three national companies. The national company holds a 50 percent stake. The concession agreements call on operators to follow generally accepted industry methods “to prevent loss and waste of petroleum.” Other clauses of the agreements create potential conflicts (see section 7 of this case study).

Legislative Jurisdictions

National laws and regulations govern the flaring and venting of associated gas.

Associated Gas Ownership

The government owns all oil and gas resources. The partner companies in the PSCs are given title to their shares of the produced oil and gas, including associated gas, provided it is used in field operations (for example, for power generation or enhanced oil recovery). They can dispose of their shares of oil and gas extracted per the terms of the PSC. Priority is given to meeting local gas market requirements, as determined by the participating national company. Other clauses in PSCs govern the pricing and sharing of associated gas under different circumstances and at different times of an asset’s life (see section 11 of this case study).

Regulatory Governance and Organization

Regulatory Authority

The Ministry of Petroleum and Mineral Resources plays an overarching regulatory role in the oil and gas sector. Although there is no specific reference to flaring or venting in PSCs, contractors and operators are subject to Law 4 and the associated regulations. The ministry often acts through the EGPC, EGAS, and the Ganoub El Wadi Petroleum Holding as joint venture partners with companies investing in Egyptian upstream assets. The EEAA is part of the Ministry of Environment and is the environmental regulator responsible for conducting an environmental impact assessment of new upstream oil and gas projects, and monitoring emissions from combustion.

Regulatory Mandates and Responsibilities

Article 40 of Environmental Protection Law 4, 1994/2009 , requires emissions from combustion for all purposes to be within the limits detailed in the annexes of Executive Regulations 338, 1995 (amended in 2005). The emissions listed do not include carbon dioxide or methane. Article 40 also states that the responsible parties will “be held to take all precautions necessary to minimize the pollutants in the combustion products.”

The second edition of the guidelines for environmental impact assessments, published in 2009 by the EEAA, does not specifically mention flaring or venting, but covers gaseous emissions from industrial activities. Petroleum operations such as exploration and production activities, pipeline construction, refineries, petrochemical facilities, processing facilities, and natural gas distribution networks are among the projects listed under Category B (with potential adverse environmental impacts) and Category C (which have highly adverse impacts) in Annex 5 and Annex 6 of the guidelines.. Article 43 of Executive Regulations 338, 1995, covers oil and gas operations and calls for best international industry practices to prevent gas leaks and flares and vents. The EGPC is responsible for approving or reviewing environmental impact assessments and environmental protection measures consistent with global best practices, and ensuring proper implementation.

Monitoring and Enforcement

The EEAA is responsible for checking compliance with environmental regulations and enforcing the results of environmental impact assessments. It has the authority to conduct inspections (see section 13 of this case study). The national companies have access to operating facilities as partners in joint ventures and act as liaisons between the partnership operating the field and the EEAA during an environmental impact assessment. In accordance with the PSC terms, the national companies approve development plans, which may include associated gas utilization options, and are responsible for ensuring compliance with development plans. Gas utilization may cover flaring and venting.

Licensing/Process Approval

Flaring or Venting without Prior Approval

PSCs state that if associated gas cannot be used, the national company and “the contractor shall negotiate in good faith on the best way to avoid impairing the production in the interests of the parties.” One implication of this clause is that flaring or venting is not curtailed if doing so is detrimental to the project economics.

Authorized Flaring or Venting

No explicit language on the authorization of flaring or venting could be identified in available official documents. The language in PSCs and Executive Regulations 338, 1995 , suggest that as long as flaring and venting were allowed under the development plan and the EIA—both overseen by the national companies in the joint venture—there is no need for a separate permit.

Development Plans

PSCs require development plans. The initial plan describes the development concept for efficient exploitation of oil, gas, and condensate reserves to meet the needs of domestic and external markets. Upon a commercial discovery, the national company and the contractor produce a more detailed development plan, which is then submitted for approval by the minister of petroleum and mineral resources.

A current map of the National Gas Pipeline Grid System is provided in an annex of a typical PSC; it has equal force and effect as other provisions of the PSC. The map is referenced in parts of the PSC that address the gas sales agreement; it is used primarily to identify the nearest connection to the pipeline grid.

A recent PSC sets forth various fiscal terms relating to cost recovery, expenses, and production sharing . It allows for allocating gas (and, if gas is processed, liquefied petroleum gas [LPG]) that is not used in operations by the national company and the contractor. The PSC also provides principles and formulas to be used to determine the prices of gas and LPG. The prices for the local market are negotiated by the EGPC or EGAS and the contractor; the export price of gas is calculated as a netback value. These prices are used in the valuation of associated gas in cost-recovery calculations. The PSC provides details on the sales of gas and LPG in local and export markets, pricing and payments associated with such sales, and the rights of the EGPC and EGAS, as defined in the gas sales agreements.

Economic Evaluation

No regulatory requirement to evaluate opportunities to minimize flaring and venting could be identified in available official documents. PSCs offer a structure for facilitating the sale of more associated gas to the EGPC and EGAS—and to other parties once the gas sector is reformed—for the local market.

Measurement and Reporting

Measurement and Reporting Requirements

No evidence regarding the measurement and reporting requirements could be found in the sources consulted. However, industry studies suggest that the EGPC, as the joint venture partner, has access to flaring and venting data. The environmental impact assessment of oil and gas activities requires a monitoring plan, which should outline “monitoring intervals and reporting procedures” of the air emissions covered in the assessment. Article 17 of Executive Regulations 338, 1995 , requires regulated entities to maintain records. Article 18 empowers the EEAA to conduct inspections and tests to confirm the accuracy of records. Article 43 assigns some responsibilities to the EGPC. In early 2022, the EGPC signed a memorandum of understanding with a private company on a flare recovery initiative. The company will deploy a suite of tools to manage emissions via measurement, recovery, and utilization of flare gas.

Measurement Frequency and Methods

No evidence regarding specified measurement frequency and methods could be found in the sources consulted.

Engineering Estimates

No evidence regarding engineering estimates could be found in the sources consulted.

Record Keeping

Under the environmental impact assessment, operators must keep a log of emissions from combustion. No reference to flared gas volumes and composition could be identified in the assessment guidelines or other official documents. However, PSCs focus on marketing LPG (mostly propane and butane separated from other natural gas liquids during processing), suggesting that other hydrocarbons can be flared or vented. PSCs’ focus on LPG also suggests that records on volumes are kept for fiscal purposes, at least for some natural gas liquids.

Data Compilation and Publishing

Industry reporting suggests that the EGPC has flare volume data, but a public report detailing these data could not be found in the sources consulted.

Fines, Penalties, and Sanctions

Monetary Penalties

No evidence regarding monetary penalties could be found in the sources consulted.

Nonmonetary Penalties

No evidence regarding nonmonetary penalties could be found in the sources consulted. PSCs give national companies partnering in joint ventures certain rights over associated gas, which may lead them to take over the gas rights from the partners. However, it is unclear whether such a situation leads to any changes in the volumes of flared or vented gas.

Enabling Framework

Performance Requirements

No evidence regarding performance requirements could be found in the sources consulted.

Fiscal and Emission Reduction Incentives

No evidence regarding fiscal or emission-reduction incentives could be found in the sources consulted.

Use of Market-Based Principles

Egypt has implemented two CDM projects. One, registered in 2006, targeted methane venting at a landfill facility. The second project, registered in 2013, targeted flare gas recovery at a large refinery.

Negotiated Agreements between the Public and the Private Sector

Development plans for upstream facilities must be agreed upon by all joint venture partners including the national companies. These negotiated plans provide the main opportunity for incorporating flaring and venting reduction from the beginning of concept development.

Interplay with Midstream and Downstream Regulatory Framework

The government has been promoting the use of more natural gas within the economy. It has a strategy for increasing the use of compressed natural gas (CNG) vehicles. The government provides financial support for converting older gasoline or diesel vehicles into CNG, selling new CNG vehicles, and expanding the CNG filling station network. EGAS is expanding the distribution network to connect more residential buildings to gas supplies. The government enacted a new Gas Market Law (No. 196) in 2017 and established the Gas Regulatory Authority in 2017. The sector’s restructuring is intended to introduce competition in the gas market via third-party access to the pipeline network. This restructuring aims to give consumers or gas-trading companies the ability to procure gas supplies from producers within Egypt or via LNG imports. Previously, EGAS was the single buyer of natural gas and the de facto regulator of the gas sector.

The Cabinet sets the prices of natural gas delivered to different customer classes. As part of gas market reforms, prices were raised for all buyers except residential consumers. Industries such as cement found the reformed gas prices too high and switched to coal. In 2020, the Cabinet lowered gas prices for all industrial users. Given the increased availability of LNG and increased domestic gas production, lower prices may still allow suppliers to recover costs. The market reforms are promising, since gas prices below cost-recovery levels are among the factors discouraging investment in efforts to reduce flaring and venting at oil and gas facilities. However, the Cabinet’s differentiation of prices by customer class, and the risk of frequent readjustments, create uncertainty.

These reforms and government efforts to increase gas use may create incentives for operators to capture more of the associated gas they are currently flaring or venting. The strength of the incentive depends on the proximity of the field to processing facilities and pipeline networks, the age of the field, the gas-to-oil ratio, the share of natural gas liquids in produced volumes, and other technical and geological factors. The recovery and utilization of flared associated gas is listed as a mitigation action in Egypt’s updated NDC of June 2022. The NDC mentions 17 implemented projects and another 36 projects to be implemented by 2030. Projects typically use captured gas for on-site power generation to replace diesel, or access existing pipelines and processing facilities