Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

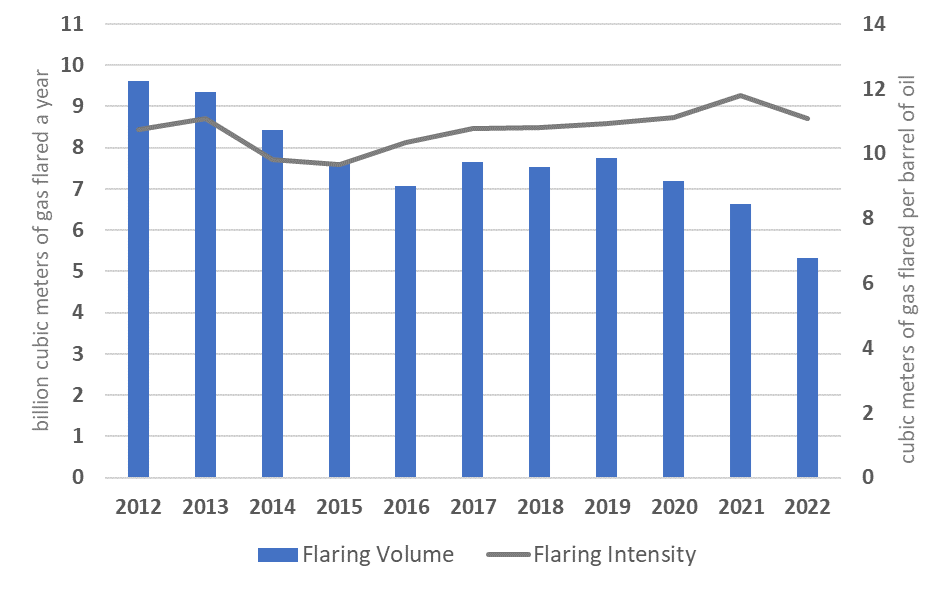

Nigeria’s oil production almost halved from 2012 to 2022. During this period, the flaring intensity barely changed. The volume of gas flared declined broadly in proportion to oil production, falling 45 percent, from 9.6 to 5.3 billion cubic meters (Figure 8). There were 174 individual flare sites in the most recent flare count, conducted in 2022.

Figure 8 Gas flaring volume and intensity in Nigeria, 2012–22

In June 2016, Nigeria endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. It also participates in the Global Methane Initiative, the Global Methane Pledge, and the Climate and Clean Air Coalition. The Nigeria’s National Plan to Reduce Short-Lived Climate Pollutants, released at the end of 2018, targets for the oil and gas industry to reduce fugitive methane emissions and leakage by 50 percent by 2030.

Nigeria submitted its first Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change in 2015. It included gas flaring reduction as a mitigation measure in its updated NDC, submitted in July 2021, where Nigeria commits to an unconditional reduction of 20 percent. The conditional reduction target is 47 percent. The update does not include unconditional contributions pertaining to the energy sector. Among the sector’s conditional contributions are zero routine flaring by 2030 and a 60 percent reduction in fugitive methane emissions by 2031.

Early oil and gas legislation—such as the Petroleum Act, 1969, and the Associated Gas Re-injection Act, 1979—included the prevention of atmospheric pollution and the conservation of resources. The Associated Gas Re-injection Act, 1979, prohibited gas flaring without the written permission of the minister in charge of oil and gas after January 1, 1984. However, measures to reduce flaring gained only limited traction, and the deadlines for ending routine flaring were repeatedly postponed.

In December 2017, the Ministry of Petroleum Resources published the National Gas Policy in the official gazette. The policy commits the government to taking measures to ensure the development of flare capture and utilization projects and to work collaboratively with the industry, development partners, providers of flare-capture technologies, and third-party investors. The policy also points out that the gas flaring penalty (at the time equivalent to US$0.03/thousand standard cubic feet [mscf]) was too low to act as a disincentive (making it more economic to flare) and needed to be raised substantially. The annual Oil and Gas Industry Reports published by the Nigeria Extractive Industries Transparency Initiative (NEITI) show that, even at this very low penalty rate, some producers have not paid flaring penalties in full or at all.

In 2016, the government launched the Nigeria Gas Flare Commercialization Program (NGFCP), targeting 2020 as the year by which routine flaring would be ended. This target was not met. In 2018, the government issued the Flare Gas (Prevention of Waste and Pollution) Regulations, 2018, followed by four sets of associated guidelines and a reporting template. An important feature of the 2018 regulations was a marked increase in the flare payment rate. The 2018 regulations also provided a mechanism, similar to the one in Indonesia, for the government to take natural gas that would otherwise be flared and bid it out to third parties to commercialize it.

In August 2021, former President Buhari signed the Petroleum Industry Act, 2021 (Petroleum Industry Act hereafter), an omnibus act covering the entire oil and gas value chain. Although it repealed some previous laws, such as the Associated Gas Re-injection Act, 1979, the Petroleum Industry Act considers most other laws and regulations equivalent to having been issued by the new regulators as long as their provisions are not inconsistent and until such a time as amendments to the new law repeals them. In particular, it retains the Petroleum Act, 1969, and several other laws until all licenses and leases signed under them are terminated. The Petroleum Industry Act contains five articles on gas flaring, promoting minimization of flaring and reinforcing the basic principles in the Flare Gas (Prevention of Waste and Pollution) Regulations, 2018. Gas Flaring, Venting and Methane Emissions (Prevention of Waste and Pollution) Regulations, 2023 (the Emissions Regulations hereafter) replaced the 2018 regulations.

Targets and Limits

The Associated Gas Re-injection (Continued Flaring of Gas) Regulations, 1984, set criteria for when flaring is allowed. No evidence of enforcement is available in the sources consulted. The National Effluent Limitation Regulation, 1991, issued by the Federal Environmental Protection Agency, placed limits on the concentrations of hydrocarbons in atmospheric emissions. According to Section 12.3 of the Emissions Regulations , the regulator will establish biannually the gas flaring threshold for licensees, lessees, and facilities.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

The Petroleum Act, 1969 , granted to the minister in charge of oil and gas the exclusive power to issue regulations, including regulations supporting the conservation of petroleum resources and the prevention of atmospheric pollution. The Petroleum Industry Act narrows the powers of the minister and transfers some previously held powers to the newly established Nigerian Upstream Regulatory Commission (the Commission hereafter) and Nigerian Midstream and Downstream Regulatory Authority (the Authority hereafter). Section 105 authorizes the Commission to take gas destined for flaring at the flare stack free of charge, which is codified in Section 3.1 of the Emissions Regulations .

Also, in November 2022, the Commission issued the Guidelines for Management of Fugitive Methane and Greenhouse Gases Emissions in the Upstream Oil and Gas Operations in Nigeria (NUPRC Guide 0024-2022). The guidelines target NDC goals of zero routine flaring by 2030 and a 60 percent reduction in methane emissions by 2031; they also detail requirements for inspecting and repairing equipment to prevent flaring and venting as well as fugitive methane emissions in both new and existing facilities in the upstream industry. The Commission intends to issue Nigeria Upstream Fees and Rents Regulations, in which penalties applicable to noncompliance with these guidelines will be defined. The Authority, in its Environmental Regulations for Midstream and Downstream Petroleum Operations in Nigeria, 2022 (Environmental Regulations hereafter) requires operators of processing, transport, and distribution of hydrocarbons and oil or refined product storage facilities to monitor and control methane emissions (as well as other greenhouse gases [GHGs]). Operators are also required to make an inventory of all methane emission sources and perform leak detection and repair in the future.

The Federal Environmental Protection Agency Act, 1988 , empowers the agency to take measures to reduce air and noise pollution. In performing its functions, the agency may inspect permits, licenses, and devices used for environmental protection; enter land, buildings, and vehicles; and perform tests. The Environmental Impact Assessment Act, 1992 , requires the authorization of any decision likely to affect the environment (Section 1) and names the oil and gas industry as one of the industries requiring a mandatory study (Section 12).

Section 7 of the Niger Delta Development Commission (Establishment, etc.) Act, 2000, states that the Niger Delta Development Commission is to tackle economic and environmental problems in the Niger Delta region and advise the federal government and member states on preventing and controlling oil spills, gas flaring, and environmental pollution. It states that the Niger Delta Development Commission is to liaise with oil and gas prospecting and producing companies on pollution prevention and control.

Legislative Jurisdictions

Flaring, venting, and methane emissions are under national jurisdiction. All laws are signed by the president of the Federal Republic of Nigeria, and regulations are prepared by line ministries in the federal government, except in oil and gas, where they are prepared by the Commission and the Authority.

Associated Gas Ownership

Associated gas is owned by producing companies under concession contracts according to their shares in the joint venture partnership. Under production-sharing contracts (PSCs) and service contracts, 100 percent of all hydrocarbons produced belong to the concessionaire, the Nigerian National Petroleum Company Limited (NNPC Ltd). The contractor, as the producing company, is entitled to only cost-recovery or profit oil or gas, as specified in Part IV of the Seventh Schedule of the Petroleum Industry Act . The PSC must explicitly state the gas-sharing scale, similar to the oil-sharing scale as outlined in Section 14.4 of Part IV of the Seventh Schedule. The Commission can take any gas that is flared free of charge (Section 105.2 of the Petroleum Industry Act) and issue permits to qualified applicants via auctions to commercialize flare gas (Section 3 of the Flare Gas [Prevention of Waste and Pollution] Regulations, 2018; see footnote 6).

Regulatory Governance and Organization

Regulatory Authority

The Petroleum Industry Act assigns significant regulatory powers to the Commission and the Authority. The Commission has regulatory authority over gas flaring and venting in upstream oil and gas production. The Authority regulates activities midstream and downstream of oil and gas production, including flared or vented gas.

The Federal Environmental Protection Agency regulates air quality and other environmental emissions, including in the oil and gas industry. The National Environmental Standard and the Regulations Enforcement Agency ensure compliance with international treaties in the oil and gas sector.

Regulatory Mandates and Responsibilities

Under the Petroleum Industry Act the minister of petroleum is responsible for policy formulation. The Commission and the Authority are responsible for technical and commercial regulation of their respective areas. Sections 6 and 7 enumerate the objectives of the Commission, which include ensuring strict implementation of environmental policies, laws, and regulations; ensuring minimization of waste and optimization of government revenues; setting and enforcing standards and regulations; issuing permits and other authorizations; and conducting all licensing rounds. Previously, many of these responsibilities belonged to the minister under the Petroleum Act, 1969 .

The Environmental Protection Agency Act, 1988 , empowers the agency to inspect, search, seize, and arrest in its areas of responsibility, which include air quality control, ozone protection, and noise control. Regarding oil-related pollutants, Paragraph 24 explicitly mentions providing support to the Ministry of Petroleum Resources when requested. The National Environmental Standard and Regulations Enforcement Agency (Establishment) Act, 2007 , empowers the agency to enforce compliance with international treaties and agreements in the oil and gas sector, in Paragraph 7, but explicitly excludes authority over any other activities in the sector.

Monitoring and Enforcement

The Petroleum Industry Act grants nearly all monitoring and enforcement powers to the Commission and the Authority. The minister of petroleum revokes or suspends licenses upon the recommendation of either of the regulators.

Licensing/Process Approval

Flaring or Venting without Prior Approval

According to Section 12 of the Emissions Regulations , flaring is allowed without a permit only in case of an emergency.

Authorized Flaring or Venting

Subject to Section 104(1) of the Petroleum Industry Act , flaring, venting, or wasting gas without Commission authorization is an offense according to Section 3.7 of the Emissions Regulations . Section 12 states that flaring is allowed under the threshold approved by the Commission as long as flaring fee is paid.

According to Section 3.3.1 of the NUPRC Guide 0024-2022 , cold venting is prohibited without a waiver from the Commission.

Development Plans

Section 108 of the Petroleum Industry Act requires all licensees and lessees to submit a natural gas flare elimination and monetization plan (FEMP) to the Commission, which is codified in Section 3 of the Emissions Regulations . The FEMP must outline the methodology for flaring elimination and monetization, and an associated implementation plan and timeline.

Also, NUPRC Guide 0024-2022 requires the submission of a GHG management plan during design, installation, and modification of facilities. This plan can be submitted as part of the field development plan, concept and front-end engineering design, or as requested by the Commission. GHG management plans are due within six months of the issuance date of the guidelines (November 2022).

The Authority’s Environmental Regulations require mandatory monitoring, estimation of volume, and reporting of GHGs; and plans for carbon capture, decarbonization, and net-zero targets of midstream and downstream operations. The Authority is expected to release guidelines for GHG inventory reporting and mitigation.

Economic Evaluation

Paragraph 43 of the Petroleum (Drilling and Production) Regulations, 1969 , requires the producer to submit a feasibility study, program, or proposals for the utilization of natural gas no later than five years after the commencement of production. However, the Petroleum Industry Act grants the ownership of all associated gas produced in PSCs to the restructured national oil company NNPC Ltd, which also signs all future PSCs representing the Federation. As such, there is no stand-alone economic evaluation of associated gas monetization. The costs of gas capture are recovered from the crude oil revenue, and gas flaring is an offense under Section 104 of the Petroleum Industry Act (see section 10 of this case study).

Measurement and Reporting

Measurement and Reporting Requirements

Section 106 of the Petroleum Industry Act codifies the requirements of metering according to the regulations of the Commission or the Authority. Part V of the Gas Flaring, Venting and Methane Emissions (Prevention of Waste and Pollution) Regulations, 2023 , contains measurement and reporting requirements, including procedures, that are further detailed in the Guidelines for Flare Gas Measurement, Data Management and Reporting Obligations. NUPRC Guide 0024-2022 requires proper tracking and reporting of activities that emit fugitive emissions, including flaring and venting and other methane leaks. Appendix A of the Guide summarizes various reporting requirements. An annual report should demonstrate compliance with each section of the guidelines. The report should include the total number of facilities inspected, inspections, leaks identified (by component and type of facility), leaks repaired, and leaks waiting to be repaired. Data on flare efficiency, cold venting, unlit flares, and records on testing of flares should be included for each flare.

Measurement Frequency and Methods

The Gas Flaring, Venting and Methane Emissions (Prevention of Waste and Pollution) Regulations, 2023 , require daily log-keeping of all gas produced, consumed on site, delivered to offtakers, flared, vented, or lost to incomplete combustion or fugitive emissions. Section 3 of the Guidelines for Flare Gas Measurement, Data Management and Reporting Obligations , administered by both the Commission and the Authority, spell out data measurement, accounting, and reporting requirements. They include 13 subsections and many detailed technical specifications. NUPRC Guide 0024-2022 requires inspections of leaks at all facilities using leak detection and repair instruments approved by the Commission. The frequency is one inspection in the first year after the implementation of the guidelines, two inspections in the second year, and four inspections in subsequent years. The inspection must observe adequacy of flares according to specifications in Section 3.2.3 of the guidelines. These inspections are in addition to the annual flare control test required in Section 3.3.2.

Engineering Estimates

Section 3.9 of the Guidelines for Flare Gas Measurement, Data Management and Reporting Obligations provides for computation procedures during the transition period before the required meters are fully installed. The same procedures are to be followed in the event that one or more meters are unavailable or not functioning properly. NUPRC Guide 0024-2022 does not mention estimation of flare or vent volumes; instead, it emphasizes frequent inspections, leak detection, and repair. Estimation of GHG emissions is allowed in Section 4.1.

Record Keeping

NUPRC Guide 0024-2022 details recordkeeping requirements in Section 3.2.4. Under sections of cold venting, flare efficiency, pneumatic controllers, and liquid storage tanks, operators are asked to keep records. Except for pneumatic controllers, which are required to keep records for at least five years, there is no time limit mentioned.

Data Compilation and Publishing

According to Section 20 of the Gas Flaring, Venting and Methane Emissions (Prevention of Waste and Pollution) Regulations, 2023 , the Commission shall publish an annual report of the submissions by regulated entities on its web site. Data on each producer will be available. In addition, comparative performance analyses and penalties will be reported. In addition, NEITI collects data and publishes them in its annual Oil and Gas Industry Reports . NEITI’s Oil and Gas Audit Reports from 1999 to 2020 contain flaring data and penalties paid by individual companies.

In January 2020, the NNPC created a new web page entitled EITI Support Open Data, which includes data on gas utilization, re-injection, and flaring from operations with NNPC participation; there are no data from operations that do not include NNPC participation. The data, in spreadsheet format, are uploaded on the NNPC’s external website with a time lag as short as a month. Separately, in August 2015, the NNPC began publishing its monthly financial and operational performance reports covering gas flared in operations with NNPC participation,. As of September 2021, the most recent data published on the EITI Support Open Data website were from July 2021.

Fines, Penalties, and Sanctions

Monetary Penalties

Section 21 of the Emissions Regulations imposes an administrative fine of US$3.50 per mscf if gas is flared, vented, or wasted without Commission authorization. Any licensee, lessee, or producer that fails to submit gas data according to regulations or fails to install metering equipment according to the regulations, or commits another specified violation, is subject to an administrative fine of US$10,000.

There have been flaring fees based on previous regulations. NEITI has been tracking the payment records. According to the Oil and Gas Audit Reports published by NEITI , US$308 million was paid in 2019, up from US$15 million in 2018. In 2020, payments fell to US$257 million, in line with the fall in overall production. The Commission (Department of Petroleum Resources [DPR] at the time) began issuing invoices for the new flare payments only in 2019. The huge increase that year illustrates the impact of the substantial increase in the flare payment rates.

According to the Midstream and Downstream Gas Infrastructure Fund Regulations, money received from flaring penalties “shall be for the purpose of environmental remediation and relief of the host communities.”

Nonmonetary Penalties

Under Section 3 of the Petroleum Industry Act , the minister of petroleum can revoke or suspend petroleum licenses and leases for noncompliance, upon the recommendation of the Commission. Section 217 states that any dispute between a licensee or a lessee and the Commission is to be settled by the Federal High Court.

Enabling Framework

Performance Requirements

NUPRC Guide 0024-2022 introduces several performance requirements for oil and gas equipment. For example, it requires the 98 percent destruction removal efficiency of flares. Inspections are necessary to ensure proper flare operations and repair of malfunctioning flares (for example, an unlit flare causing venting must be repaired within 48 hours). Pneumatic controllers must be zero bleed or low bleed (emitting less than 0.17 scm per hour of natural gas). There are similar performance requirements for other equipment with the potential to emit methane.

Fiscal and Emission Reduction Incentives

Paragraph 11 of the Petroleum Profits Tax Act, 1958 , provides incentives for gas separation and treatment investments by making such investments deductible against revenue. The incentives were extended to nonassociated gas in 1999, and therefore they are no longer specific to associated gas. The Petroleum Industry Act repeals the Petroleum Profits Tax Act, 2018, for new acreages. Section 39 of the Companies Income Tax Act, 1990, provides large fiscal incentives for gas utilization. The section offers the following benefits:

- an initial tax-free period of three years, renewable for an additional two years, or an additional investment allowance of 35 percent

- accelerated capital allowance of 90 percent a year after the tax-free period and an additional capital allowance of 15 percent without reducing the asset value

- tax-free dividends during the tax-free period if the investment is in a foreign currency and imports are not less than 30 percent of the company’s equity share capital

- the deductibility of loan interest payments, provided the minister of petroleum resources approved the loans.

Section 104 of the Petroleum Industry Act (footnote 9) states that fines paid for flaring are not eligible for cost recovery and are not tax deductible. Section 264 disallows the deduction of “expenditure incurred as a penalty, natural gas flare fees or imposition relating to natural gas flare” for the “purpose of ascertaining the adjusted profit of a company in the accounting period from its upstream petroleum operations applicable to crude oil.” Section 260 exempts production of associated and nonassociated natural gas from the new hydrocarbon tax; it allocates costs of producing associated gas to crude oil as a deduction in calculation of the hydrocarbon tax. Part IV, Section 10(6) of the Seventh Schedule sets the royalty for natural gas utilized in-country at 2.5 percent versus 5 percent for all other natural gas and natural gas liquids. Royalties are applied to chargeable volumes as defined in Part III, Section 7(5) of the Seventh Schedule and exclude “volumes burned, flared or vented with the approval of the Commission.”

Use of Market-Based Principles

The Emissions Regulations provide for the Commission to conduct competitive auctions in which third parties can bid for gas currently being disposed via flaring, venting, or waste. The NGFCP announced the first auction in November 2018.

The NGFCP was relaunched in October 2022, to advance the government’s goal of achieving zero routine flaring within this decade. The NGFCP 2022 has been restructured to offer flare sites to technically and commercially competent third-party investors through a competitive and transparent bid process. The auction was closed in late March 2023 after several extensions of the submission deadline.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

Interplay with Midstream and Downstream Regulatory Framework

The Companies Income Tax Act, 1990 , provides incentives for the utilization of associated and nonassociated natural gas. Gas utilization is defined as the marketing and distribution of natural gas for commercial purposes and includes power generation, LNG, gas-to-liquid plants, fertilizer production, and gas transmission and distribution pipelines. Nigeria also adopted a gas transport network code in 2020, formalizing third-party access to critical gas infrastructure. The Petroleum Industry Act separates upstream, midstream, and downstream operations. Regulatory oversight of the upstream are transferred from the Department of Petroleum Resources to the Commission and regulatory oversight of midstream and downstream are transferred to the Authority (see section 6 of this case study), which has also assumed functions of the Petroleum Products Pricing Regulatory Agency, and the Petroleum Equalization Fund (Management) Board. Companies are required to create separate companies for each segment and acquire the necessary licenses from the Commission or the Authority. This structure and other provisions of the Petroleum Industry Act (see section 21 in this case study) are intended to promote natural gas production and utilization.

According to Section 173 of the Petroleum Industry Act, the Authority will determine the domestic gas demand requirement for strategic sectors by March 1 of every year and inform the Commission of this requirement. As per Section 110, the Commission is responsible for ensuring compliance of every lessee and can charge a penalty of US$3.50 per million British thermal units for failure to comply. This penalty and implementation of the domestic gas obligation can be modified by the Commission according to the guidelines provided in Section 110 and other sections of the Petroleum Industry Act. As per Section 167, unless lessees sign agreements with buyers from the strategic sectors, the Authority will determine the domestic base price for gas, which “must be of a level to bring forward sufficient natural gas supplies for the domestic market on a voluntary basis by the upstream petroleum industry” under the Third Schedule of the Petroleum Industry Act. Under Section 39 of the Companies Income Tax Act, 2020, up to five years of tax holiday is available to developers of new gas pipelines.