Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

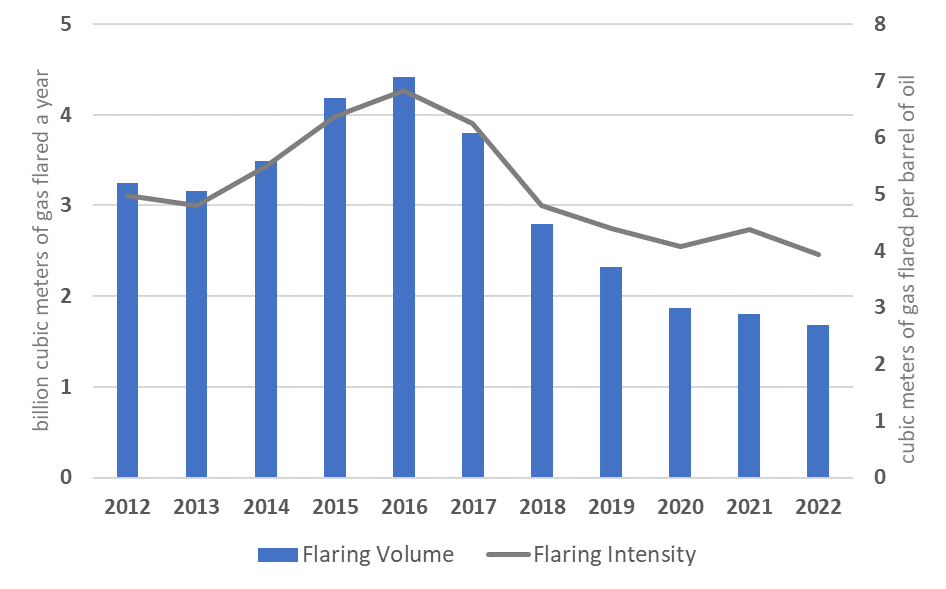

The volume of gas flared in Angola increased from 3.2 billion cubic meters (bcm) in 2012 to 4.5 bcm in 2016 before falling to 1.7 bcm in 2022 (Figure 1). Oil production increased slightly in 2015, but has been declining steadily since then. The flaring intensity was 21 percent lower in 2022 than in 2012. There were 53 individual flare sites in the most recent flare count conducted in 2022.

Figure 1. Gas flaring volume and intensity in Angola, 2012–22

In 2015, Angola endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. In mid-2021, it submitted an updated Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change and committed to an unconditional reduction in greenhouse gas emissions from the business-as-usual scenario of up to 14 percent by 2025. Emissions under the business-as-usual scenario are projected to be 108.5 million tonnes of carbon dioxide equivalent (tCO2e) in 2025. The conditional commitment is another 10 percent reduction by 2025. Base year (2015) emissions were 100 million tCO2e. Flare reductions account for two-fifths of unconditional and one-third of conditional commitments. However, the target reductions in gas flaring are seemingly based on old data, from a period in which Angola’s oil production was much higher. The flare gas reduction targets stipulated in the NDC (3 bcm year in the unconditional contribution) far exceed the actual volumes of gas being flared (1.9 bcm in 2020). These targets therefore need to be interpreted with caution.

Most of Angola’s natural gas production is associated with oil produced in the offshore fields off the coast of Cabinda and the deep-water fields in the Lower Congo Basin. Historically, the majority of natural gas extracted has been re-injected in oil fields to enhance oil recovery or flared. In 2011, re-injection and flaring still accounted for 91 percent of all the natural gas produced in the country. The gas utilization policy focused on developing the country’s first LNG facility, in Soyo. Although the first LNG cargo was exported in 2013, exports remained low until 2017 but increased nearly tenfold by 2020.

Targets and Limits

No evidence regarding targets and limits could be found in the sources consulted. However, there is a de facto zero-flare policy for all new fields.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

In 2018, as a result of a 2017 Presidential Task Force, the government of Angola responded to lower oil prices with legal reforms. Law 10/2004, Petroleum Law (Petroleum Law, 2004 hereafter), as amended by Law 5/2019, repealed Law 13/1978, General Law on Petroleum Activities. This law sets forth the general framework applicable to oil operations in Angola. It governs activities related to prospection, concession, search, assessment, development, and decommissioning. Law 13/2004, the Taxation of Petroleum Activities Law, as amended by Law 6/2019, defines the fiscal regime applicable to oil and gas activities. Law 26/2012, the Law on the Transportation and Storage of Crude Oil and Natural Gas, establishes the legal framework for downstream operations—namely, the transport and storage activities of crude oil and natural gas.

Decree 1/2009, Regulation on Petroleum Operations, defines and establishes the conditions and procedures to be observed in upstream oil and gas operations. Decree 7/2018 and Law 8/2018 are the first pieces of legislation enacted to regulate natural gas operations and provides more attractive tax rates for small producers. Operators of associated gas fields can re-inject gas to maximize oil recovery, commercialize the surplus, or transfer it to the Angolan LNG plant.

Law 5/1998, the General Environment Law, provides the framework for environmental legislation and regulation. Executive Decree 97/2014 enacts the Regulations on Management of Operational Discharges. Decree 39/2000 concerns environmental protection in the oil industry and enacts environmental protection regulations for oil and gas activities. Contractors must prepare and submit an EIA to the Ministry for Mineral Resources, Petroleum, and Gas (Ministério dos Recursos Minerais, Petróleo e Gás [MMRPG]) for approval before starting any petroleum activities. The assessment needs to identify predictable environmental damages caused by the proposed petroleum activities and outline the necessary measures to decrease said damages.

Legislative Jurisdictions

Gas flaring and venting are matters of national jurisdiction.

Associated Gas Ownership

Angola’s 2010 Constitution vests all resources in the soil and subsoil, territorial waters, exclusive economic zone, and continental shelf in the Angolan state. The Petroleum Law, 2004 , prescribes that all petroleum deposits are an integral part of the state’s public domain, including all onshore and offshore petroleum reserves.

The most common type of association agreement with the national oil company, the Angola National Fuel Company (Sociedade Nacional de Combustíveis de Angola, [Sonangol]), is the PSC. According to Angola’s model PSC, companies have the right to use any associated gas produced in their oil activities, process it, and separate any liquids from it. However, any surplus gas must be given to Sonangol free of charge. If nonassociated natural gas is discovered within the contract area, Sonangol is free to develop it on its own account or in association with third parties.

Regulatory Governance and Organization

Regulatory Authority

The MMRPG, created in 1978, oversees petroleum activities. It focuses mainly on coordination and cooperation with other entities. Its statute is provided under Presidential Decree 12/2018 as amended by Presidential Decree 159/2020. Other ministries, such as the Ministry of Environment and the Ministry of Finance, also have some degree of oversight and regulatory powers.

Law 5/2019 created a new regulator, the National Oil, Gas and Biofuel Agency (Agência Nacional de Petróleo, Gás e Biocombustíveis). Presidential Decree 49/2019 provides the organic statute of this regulator, which took over from Sonangol as the exclusive holder of mineral rights for oil and gas exploration and production. Law 5/2019 granted Sonangol preferential acquisition and operational rights in oil and gas concessions and operations.

Regulatory Mandates and Responsibilities

The primary role of the National Oil, Gas and Biofuels Agency, subject to the ministry’s supervision, is to regulate, supervise, and promote the execution of petroleum activities—namely, the exploration, exploitation, development, and production of minerals, crude oil and gas; refining and petrochemicals; and the storage, distribution, and marketing of mineral and oil products. Article 7 of the Petroleum Law, 2004 ,2 stipulates that oil and gas operations shall be conducted prudently and consider the safety of persons and facilities as well as the protection of the environment and the conservation of nature. Article 24 requires licensees to take the precautions necessary to protect the environment in carrying out their activities. The applicable laws require environmental plans, including environmental impact studies and management and environmental auditing plans.

Monitoring and Enforcement

Article 41 of the Regulation on Petroleum Operations, 2009 describes the regulator’s inspection functions. Article 42 describes the inspector’s rights. Article 49 on competence states that the MMRPG is responsible for monitoring compliance with the regulations.

Licensing/Process Approval

Flaring or Venting without Prior Approval

Article 73 of the Petroleum Law, 2004 , expressly forbids natural gas flaring except for short periods for testing or other operating reasons, which require special permission from the MMRPG.

Authorized Flaring or Venting

Article 73 of the Petroleum Law, 2004 , states that when gas flaring is authorized, the supervising authority may determine that a relevant fee be charged in accordance with the quantity and quality of the gas flared and its location. No evidence could be found in the sources consulted on enforcement of such a fee. In the case of marginal or small deposits, the MMRPG may authorize the flaring of associated gas to make its exploitation viable. Flaring authorizations may be granted only upon submission of an EIA.

Development Plans

Article 73 of the Petroleum Law, 2004 , states that the development plans for petroleum deposits should always be formulated in such a way as to allow for the use, preservation, or commercial exploitation of associated gas. Article 22 of the Regulation on Petroleum Operations, 2009 , states that the general development and production plan must include a plan for utilizing the associated natural gas. Article 23 states that annual production plans must include a provision for flaring and venting of natural gas and estimated volumes of special fluids to be injected for enhanced recovery.

Economic Evaluation

Flaring authorizations may be granted only upon submission of a substantiated technical, economic, and environmental impact evaluation conducted by Sonangol that demonstrates that it is not feasible to exploit or preserve the natural gas.

Measurement and Reporting

Measurement and Reporting Requirements

Metering and recording practices have to follow methods and use instruments certified under the legal standards in force and in compliance with good technical standards. Article 34 of the Regulation on Petroleum Operations, 2009 , states that operators must propose to the MMRPG the measurement system, equipment, and procedures for measuring oil and gas production and sales. Article 39 lists the gas measurement system components; Article 40 describes the requirements for measurement facilities. Article 24 requires operators to submit a report providing information on all activities related to natural gas by December 30 of each year. Article 44 requires the quarterly submission to the MMRPG of a report on the systems for measuring, testing, and calibrating the equipment. The reports must include information related to daily production and respective shipments.

For PSCs, contractors are required to record the monthly quantities of crude oil, natural gas, and water produced from each development area. These data must be sent to Sonangol within 30 days of the end of the month reported on.

Measurement Frequency and Methods

All petroleum extracted and recovered shall be metered and recorded daily. Article 34 on oil and gas measurement in the Regulation on Petroleum Operations, 2009 , states that the operator must propose to the MMRPG the laboratory analysis methods required to determine all physical and chemical parameters. Article 45, on allowable tolerances, states that the maximum permissible error for gas meters must not exceed 0.1 percent of the measured volume. Sonangol and its partners do not systematically measure and report gas flaring figures.

Engineering Estimates

No evidence of engineering estimates could be found in the sources consulted.

Record Keeping

For PSCs, contractors must make available for examination daily or weekly statistics and reports regarding a contract area’s production at a time convenient to authorized representatives of Sonangol. Contractors must prepare and, at all times while a contract is in force, maintain accurate and current records of all activities and operations and keep all information of a technical, economic, accounting, or any other nature related to the conduct of petroleum operations.

Data Compilation and Publishing

No evidence regarding data compilation and publishing could be found in the sources consulted.

Fines, Penalties, and Sanctions

Monetary Penalties

Article 51 on fines in the Regulation on Petroleum Operations, 2009 , includes provisions on applicable monetary fines. If a monetary correction is needed, the penalty must be assessed under the terms of the Tax Correction Unit in force.

Nonmonetary Penalties

No evidence regarding nonmonetary penalties could be found in the sources consulted.

Enabling Framework

Performance Requirements

No evidence regarding performance requirements could be found in the sources consulted.

Fiscal and Emission Reduction Incentives

The Angola Liquefied Natural Gas Project (ALNG) is the first LNG project in Angola. It uses associated natural gas, helping to reduce gas flaring and associated greenhouse gas emissions. Daily capacity is 1.1 billion cubic feet (bcf). Decree 10/2007 created a special legal regime for the ALNG that includes specific maritime, tax, customs, and foreign exchange regimes. The ALNG is subject to a specific tax regime under which sponsor entities hold a tax credit of 144 months starting from the date of initial commercial production, deductible against the profit income tax. The ALNG is subject to a quarterly gas tax from the first LNG export shipment date. Decree 7/2018 provides more attractive tax rates to gas operations. The gas production tax is 5 percent (compared with 10 percent for oil).

PSCs state that any surplus gas produced by oil companies that is not used for field use must be given free of charge to Sonangol (see section 5 of this chapter). The capital expenditures borne by companies for the storage and delivery of associated gas to Sonangol are cost recoverable. Sonangol will manage the gas infrastructure once commissioned and will also bear the cost of operating it. Should funding the gas infrastructure have a significant negative impact on the economic conditions agreed to in the PSCs for the contractor, Sonangol is required to modify the economic terms of the contract to restore the contractor’s economic position before the gas infrastructure project.

Use of Market-Based Principles

No evidence regarding the use of market-based principles to reduce flaring, venting, or associated emissions could be found in the sources consulted.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

The fact that midstream licenses do not provide open access rights to third parties in privately constructed infrastructure could be a barrier to the commercialization of associated gas. These licenses are typically granted to companies affiliated with Sonangol. Third parties do not have access to such infrastructure if the right-of-way has already been granted for the midstream license.