Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

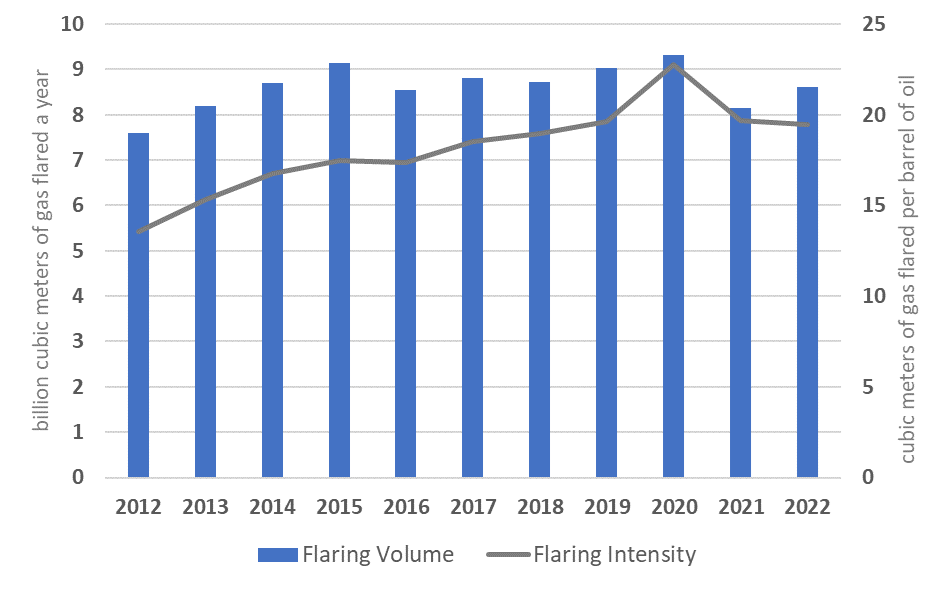

The volume of gas flared in Algeria increased from 7.6 billion cubic meters (bcm) in 2012 to 8.6 bcm in 2022, and the flaring intensity in 2022 remained high after peaking in 2020 (Figure 1). Over the same period oil production dropped by almost a quarter. Among the countries covered in this review, Algeria’s flaring intensity in 2021 was the third highest. There were 209 flare sites in the most recent flare count, conducted in 2022.

Figure 1. Gas flaring volume and intensity in Algeria, 2012–22

Note: Flare data graphs shown in this report are based on global flaring data estimates by the Global Flaring and Methane Reduction (GFMR) Partnership using satellite data from the Colorado School of Mines. This approach is applied to all countries covered in this report in a consistent manner.

In September 2015, Algeria submitted its first Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change (UNFCCC). The NDC has an unconditional target of reducing greenhouse gas (GHG) emissions by 7 percent by 2030 from a business-as-usual scenario and a conditional reduction target of 22 percent. Among the planned actions is the reduction by 2030 of flared gas volumes to less than 1 percent, presumably of the total associated gas volume (and not of total natural gas) produced. In 2018, the national oil company, Sonatrach, endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. With regards to methane, Algeria’s NDC refers to only the waste sector.

Algeria first prohibited gas flaring in 1966. Law No. 05-07, 2005, formalized the prohibition and empowered two new regulators to implement flaring and venting restrictions. Law No. 19-13, 2019, prohibits routine flaring and venting of natural gas, sets taxes on flared or vented volumes, and outlines the responsibilities of Algeria’s regulatory agencies.

In its 2017 annual report, Sonatrach stated its goal of reducing flaring to less than 1 percent of associated gas by 2021. Sonatrach is responsible for most of the flaring. It produces approximately 80 percent of oil and gas, mostly from older oil fields.

Targets and Limits

Sonatrach, in alignment with Algeria’s NDC, targets less than 1 percent of total associated gas to be flared by 2030. Law No. 19-13, 2019 , prohibits flaring and venting except under certain conditions but does not specify any targets or limits. Executive Decree 21-330, 2021, repeals Executive Decree 13-400, 2013, regarding conditions for allowed flaring. There are limits on the duration of flaring (see section 10 of this chapter). Article 9(d) limits flaring during production to 1 percent of total volumes produced but Article 9(e) allows, subject to regulatory approval, for 12 months of flaring in the case of infrastructure bottlenecks. Article 19 limits flaring during midstream activities to 1 percent of the hydrocarbons transported via pipelines or entering processing or refining facilities.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

Law No. 19-13, 2019 , empowers two national regulators to deal with flaring and venting: the Hydrocarbon Regulation Authority (Autorité de Régulation de Hydrocarbures [ARH]) and the National Agency for Valuation of Hydrocarbon Resources (Agence Nationale pour la Valorisation des Ressources en Hydrocarbures [ALNAFT]). Executive Decree 21-330, 2021 , is the main regulation on flaring.

Executive Decree No. 08-312, 2008, details the conditions of environmental impact assessments in the hydrocarbons sector and the ARH’s role in monitoring and enforcing compliance with them. Environmental impact assessments must include measures to eliminate, reduce, or compensate environmental impacts from flaring or venting.

Legislative Jurisdictions

The prohibition on flaring and venting is a national policy governed by national regulators. According to Article 44 of Law No. 19-13, 2019 , the ARH consults with other ministries and provincial governments before approving EIAs conducted at oil and gas facilities, following the procedures outlined in Article 157. Executive Decree No. 08-312, 2008 , details how the ARH will consult with other ministries and provinces during the approval of EIAs.

Associated Gas Ownership

All hydrocarbons are the property of the state until extracted. The Ministry of Energy and Mines (Ministère de l’Énergie et des Mines) allocates resource titles to ALNAFT so that the regulator can hold bidding rounds and award titles.

Article 76 of Law No. 19-13, 2019 , provides for three types of upstream contracts between Sonatrach and one or more contractors: participation agreements, production-sharing contracts (PSCs), and risk service contracts:

- According to Article 79, all extracted hydrocarbons become the property of partners at the point of measurement in participation agreements, under which the share of Sonatrach is at least 51 percent (Article 92).

- According to Article 83, all extracted hydrocarbons become the property of Sonatrach at the point of measurement in PSCs. Sonatrach transfers its share to partners at an agreed-upon point of delivery. The partners’ share of production—which is the sum of cost oil and profit oil calculated based on the fiscal terms of each PSC—cannot exceed 49 percent of the total value of oil and gas so extracted and sold (Article 93).

- According to Article 86, all extracted hydrocarbons become the property of Sonatrach in risk service contracts. The contractors are paid up to 49 percent of the total value of production.

- Article 74 allows Sonatrach to acquire an exclusive concession from ALNAFT, in which case Sonatrach owns all hydrocarbons produced.

Regulatory Governance and Organization

Regulatory Authority

Article 160 of Law No. 19-13, 2019 , states that ALNAFT and the ARH regulate flaring operations and volumes flared. The ARH develops technical regulations for oil and gas activities; ALNAFT is primarily responsible for efficient oil and gas project development. According to Article 22, both regulators are legally independent and financially autonomous. Before 2005, Sonatrach was the regulator despite also being the national oil company.

Regulatory Mandates and Responsibilities

According to Article 42 of Law No. 19-13, 2019 , ALNAFT is primarily responsible for the efficient development of hydrocarbon resources via the assessment of resource and reserve potential, the design and management of bidding rounds, and the administration of various types of upstream contracts with Sonatrach and other operators. It is also responsible for issuing authorizations for flaring in upstream operations.

According to Articles 43 and 44, the ARH develops technical regulations for the entire oil and gas value chain (upstream, midstream, and downstream); develops, in coordination with Sonatrach, plans for oil and gas infrastructure such as pipelines and storage terminals; sets environmental regulations (including atmospheric emissions); oversees GHG reporting; approves EIAs conducted by specialized companies pre-approved by the ARH; regulates pipeline tariffs and open access; and determines the prices of natural gas and petroleum products in the domestic market and tariffs for gas pipelines and processing. The ARH is also responsible for issuing authorizations for flaring in midstream and downstream operations. Before Law No. 19-13, 2019, only ALNAFT issued authorizations for flaring.

Monitoring and Enforcement

According to Article 42 of Law No. 19-13, 2019 , ALNAFT is charged with monitoring compliance with contracts, issuing authorizations covered under the law, and approving field development plans. According to Article 43, the ARH is charged with sanctioning violations of technical regulations, pipeline tariffs, and open access rulings and regulating health, safety, and the environment. The ARH certifies specialized companies to conduct inspections on its behalf and to ensure compliance with its regulations.

The ARH conducts audits, inspections, and investigations to ensure the integrity of oil and gas facilities and compliance with health, safety, and environmental regulations through the operating life of upstream, midstream, and downstream hydrocarbon facilities. It has had these responsibilities since its creation by Law No. 05-07, 2005 . Law No. 13-01, 2013, expanded the ARH’s responsibilities in health, safety, and environmental matters.

Licensing/Process Approval

Flaring or Venting without Prior Approval

According to Article 159 of Law No. 19-13, 2019 , flaring for safety does not require prior authorization. However, operators must provide a detailed report of the flare to the relevant regulatory agency within 10 days. Articles 7 and 18 of the Executive Decree 21-330, 2021 , codify these requirements for upstream and midstream operations, respectively. As per Article 26, venting for safety during pipeline transport is treated the same way. Neither the law nor the executive decree defines technical reasons for flaring for safety. However, Article 43 of Law No. 19-13, 2019, charges the ARH with developing regulations concerning industrial safety, well integrity, and prevention of risks to the health and safety of employees. At the time of writing, the ARH had not published relevant regulations for Law No. 19-13, 2019.

Authorized Flaring or Venting

Article 158 of Law No. 19-13, 2019 , prohibits flaring and venting. According to Article 3 of Executive Decree 21-330, 2021 , flaring is allowed, with prior application to ALNAFT, under certain conditions. Such conditions include: during well testing and debottlenecking; at the start-up of new facilities; at facilities built before July 19, 2005, and waiting to be retrofitted (per Article 235 of Law No. 19-13, 2019); or in the absence of sufficient takeaway pipeline or processing capacity. However, there are limits. For example, during exploration (Article 8 of the Executive Decree 21-330, 2021) the following limits are listed: 24 hours within 5 days for delineation wells, 48 hours within 10 days for wells exploring new horizons, 15 days or 5 million cubic meters (m3) for pilot wells, and 12 months or 50 million m3 for remote wells expected to produce oil and gas.

Upstream flares require authorization from ALNAFT; midstream or downstream flares require authorization from the ARH. In exceptional situations, venting during pipeline activities may be allowed, but authorization from the ARH is required.

Development Plans

A development plan needs to be approved by ALNAFT, according to Law No. 19-13, 2019 . There is no explicit requirement for this plan to include associated gas disposal, but the plan must cover all commercially exploitable hydrocarbons (Article 106). According to Article 107, the plan must also include measurement and delivery points for all extracted hydrocarbons and allow for production optimization throughout the life of the asset.

Economic Evaluation

No evidence regarding economic evaluations could be found in the sources consulted.

Measurement and Reporting

Measurement and Reporting Requirements

Flare volumes must be reported, because they are used to calculate flare taxes (see section 21 of this chapter). Taxes create an incentive for operators to measure or estimate their flare volumes as accurately as possible. Article 15 of Executive Decree 21-330, 2021 , requires the national company or contractors to report the start and end dates of flaring and the volumes flared to ALNAFT within 30 days. An annual report specifying the volumes flared is to be submitted to ALNAFT by January 31 of the following year. Article 16 requires the national company or contractors to include all flaring (regardless of the cause) in the gas material balance. The requirements for midstream activities are the same, but also include venting. Article 28 requires midstream operators to report the start and end dates of flaring and the volumes flared to ARH within 30 days. Article 24 requires midstream operators to submit an annual report to ARH by January 31 of the following year, specifying the volumes flared and vented. Article 27 requires midstream operators to include all volumes flared and vented (regardless of the cause) in the gas material balance.

Article 43 of Law No. 19-13, 2019 , requires the ARH to develop technical standards and regulations. Article 6 contains a general requirement that producers apply international best practices and techniques in hydrocarbon activities to “prevent, reduce and manage risks” associated with these activities. At the time of writing, the ARH had not published any relevant regulations for Law No. 19-13, 2019.

Measurement Frequency and Methods

No evidence regarding specified measurement frequency and methods could be found in the sources consulted. However, there is a tax on flaring (see section 21 of this chapter). Flaring taxes are collected annually; this requires that annual flaring volumes be reported, which in turn requires their measurement or estimation.

Engineering Estimates

Law No. 19-13, 2019 , does not mention the estimation of flaring and venting volumes, but the ARH is responsible for developing technical regulations following international best practices. At the time of writing, the ARH had not published any relevant regulations for Law No. 19-13, 2019. No evidence of regulators having approved estimation methods could be found.

Record Keeping

No evidence regarding record-keeping requirements could be found in the sources consulted. However, the existence of an annual flare tax suggests that operators must keep a record of flare volumes throughout the year.

Data Compilation and Publishing

No evidence regarding data compilation and publishing could be found in the sources consulted. However, Sonatrach reports flaring data from its operations in its annual reports.

Fines, Penalties, and Sanctions

Monetary Penalties

Article 227 allows the ARH to assess a daily penalty of 100,000 Algerian dinars (about US$750 as of September 2021) for noncompliance with Law No. 19-13, 2019 or its implementing regulations. The penalty starts at least a month after the offending party is notified of the violation. This delay is to allow for remediation or elimination of the violation. No evidence of penalties specific to violating flaring and venting regulations could be found in the sources consulted.

Nonmonetary Penalties

Article 226 allows ALNAFT to suspend or cancel authorizations for upstream prospecting or concessions if a licensee violates any provision of Law No. 19-13, 2019 . No evidence of nonmonetary penalties for violating flaring and venting regulations could be found in the sources consulted.

Enabling Framework

Performance Requirements

No evidence regarding specific performance requirements could be found in the sources consulted. However, the ARH is empowered to develop environmental regulations (including emissions from oil and gas operations) under Law No. 19-13, 2019 (see section 7 of this chapter, and footnote 5). However, implementing regulations had not been published at the time of writing.

Fiscal and Emission Reduction Incentives

According to Article 210 of Law No. 19-13, 2019 , there is a tax on flared volumes. This tax is nondeductible for the purposes of calculating other payments under the upstream fiscal regime. The tax is 12,000 Algerian dinars (about US$90 as of September 2021) per 1,000 cubic meters (m³). ALNAFT can adjust this tax at the beginning of every year based on the national inflation index. The tax increases by 50 percent if an operator flares without authorization (except for flares for safety reasons as stated in Article 159) or flares more than the volumes allowed in the authorization (Article 213).

According to Article 215, the tax is not due under the following conditions:

- during exploration activities or well testing

- during the start-up period, the duration of which is set by ALNAFT or ARH

- in the absence of capacity for gas recovery or takeaway (pipeline) infrastructure

- at facilities built before 2005.

According to Article 11 of Executive Decree 21-330, 2021 , in case of delays in the start-up of new facilities, the national company or contractors must include a justification along with a request for permission to extend flaring; additional volumes flared will be subject to tax. Article 21 stipulates the same requirements for flaring at midstream facilities and Article 26 for venting during pipeline transport. Article 29 requires that an annual declaration to the fiscal authority on flare taxes must include all information necessary to calculate the taxes. According to Article 30, ALNAFT and the ARH are required to provide the fiscal authority a report on each flaring operation. The report must include actual flared volumes.

Use of Market-Based Principles

No evidence regarding the use of market-based principles to reduce flaring, venting, or associated emissions could be found in the sources consulted.

Negotiated Agreements between the Public and the Private Sector

The El Merk Central Processing Facility can be considered a de facto public-private partnership. It was developed and is operated by Groupement Berkine, a joint venture between Sonatrach and several private companies. Sharing this central facility reduces the infrastructure footprint of all operators and the unit cost of processing associated gas for each participating operator. ALNAFT and the ARH were created in 2005, but the phase-out of Sonatrach’s regulatory powers took several years to complete. The El Merk Central Processing Facility was conceptualized during the 2000s and the contract awarded in early 2009.

Several other projects processing hydrocarbons from oil fields, including associated gas, were developed or expanded in the 2010s; others are still under consideration. By law, ALNAFT is responsible for the efficient development of hydrocarbon resources and the approval of field development plans. ALNAFT issues the necessary licenses, but guidance from the Ministry of Energy and Mines and Sonatrach helps determine the list of projects pursued.

Interplay with Midstream and Downstream Regulatory Framework

Article 67 of Law No. 19-13, 2019 , requires both participation contracts and PSCs to include a joint marketing clause for natural gas to be exported. Sonatrach may market the gas on behalf of the partners if all parties agree. Article 121 states that serving the national market is a priority. Partners’ share of gas, or a portion of it, is transferred to Sonatrach if ALNAFT—in consultation with Sonatrach and the Electricity and Gas Regulatory Commission (Commission de Régulation de l’Electricité et du Gaz), which is responsible for forecasting demand—decides that these volumes are necessary to serve the national market (Article 123).

Article 131 grants open access to the gas transmission pipeline infrastructure. The ARH sets the tariff. Article 146 allows gas prices to be negotiated by the sellers (Sonatrach or its upstream partners) and the buyers for volumes above the national needs, as determined by the Ministry of Energy and Mines. The ARH sets the price of gas sold to power plants and distribution companies. It must cover costs and fiscal and other charges and provide a reasonable rate of return (Article 147).

Gas prices in the domestic market are heavily subsidized. Domestic gas demand increased from about 25 bcm in 2010 to about 45 bcm in 2019, driven largely by subsidized pricing. The government has been pursuing a gasification strategy. There are programs to convert light-duty vehicles to liquefied petroleum gas (LPG) and buses and trucks to compressed natural gas (CNG) to reduce the consumption of oil products. Still, most of the demand growth reflects increased power generation and distribution in cities. Phasing out energy subsidies is seen as necessary to avoid a demand-supply imbalance and encourage further development of nonassociated gas fields.

All pipelines are developed and operated by Sonatrach under concessions granted by the Ministry of Energy and Mines (Article 127). Sonatrach delivers gas to liquefied natural gas (LNG), petrochemical and fertilizer plants, and refineries. A state-owned company, Sonelgaz, builds and operates distribution networks and serves other gas consumers.