Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

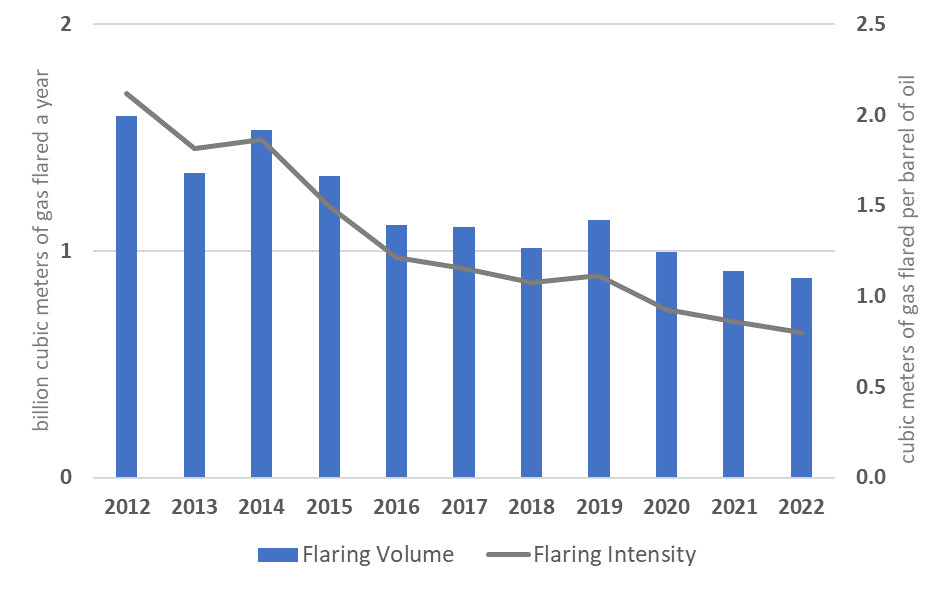

The volume of gas flared in Brazil decreased from 1.6 billion cubic meters (bcm) in 2012 to 0.9 bcm in 2022. During this period, oil production rose from about 2 to 3 million barrels a day, but associated emissions were more than offset by the 58 percent decline in flaring intensity (Figure 1). The most recent flare count, conducted in 2022, found 106 individual flare sites.

Figure 1. Gas flaring volume and intensity in Brazil, 2012–22

In 2018, the national oil company, Petrobras, endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. Brazil also participates in the Global Methane Initiative, and the Global Methane Pledge. In early 2022, Brazil submitted a second update to its Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change and committed to reducing its greenhouse gas (GHG) emissions from 2005 levels by 37 percent by 2025 and 50 percent (as compared to 43 percent in the previous update) by 2030. However, the NDC does not specifically mention gas flaring and venting.

As a result of flaring reduction and other initiatives, upstream carbon intensity declined by 25 percent between 2009 and 2015. Between 2008 and 2018, almost 10 million tonnes of carbon dioxide equivalent (tCO2e) from associated gas was re-injected. Petrobras estimates that the total accumulated re-injection will amount to the equivalent of more than 40 million tCO2 by 2025. Petrobras reports no routine flaring of gas in existing operations, because all assets under its operational control are already exporting or re-injecting gas. The company’s average gas use in 2018 was 97 percent.

Resolution 17/2017, issued by Brazil’s National Council of Energy Policy (Conselho Nacional de Política Energética), outlines the policy on oil and gas exploration and production. It establishes a guideline to increase, on an economic basis, the share of natural gas production for the domestic market, including by reducing the flaring of natural gas in upstream activities.

In March 2022, the Ministry of the Environment established the National Program for the Reduction of Methane Emissions—Zero Methane. In addition to promoting biogas and biomethane, the program’s goal is to encourage a carbon market, especially via the introduction of a distinct methane credit.

Targets and Limits

There are limits on the volume of gas that can be flared or vented by each concession area. According to Ordinance 123/2000 issued by the National Agency for Petroleum, Natural Gas, and Biofuels (Agência Nacional do Petróleo, Gás Natural e Biocombustíveis [ANP]), the Annual Production Program (Programa Anual de Produção [PAP]) approved by the regulator should include a schedule with monthly estimates of flared or vented gas. Article 3 of Resolution 806/2020 sets the maximum allowable limit for the monthly volume of flaring or venting at a level that is 15 percent above the forecasted gas-to-oil ratio based on the most recent approved PAP.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

Law 9478/1997, Petroleum Law (Petroleum Law, 1997, hereafter), governs oil and gas upstream activities in Brazil. Article 7 establishes the ANP as the lead oil and gas agency. Article 25 states that only companies that meet the ANP’s technical, legal, and economic requirements can be awarded an oil and gas exploration and production concession. Article 26 states that operators should submit their development and production projects and plans for the ANP’s approval.

Law 11.909/2009, Natural Gas Law, covers the transport of natural gas, previously covered by Article 177 of the Constitution, as well as treatment, processing, storage, liquefaction, regasification, and commercialization of natural gas.

Resolution 806/2020 replaces ANP Ordinance (“Portaria”) 249/2000 and details the criteria and procedures for controlling and reducing gas flaring and venting in upstream activities. Article 4 states that the flaring or venting of nonassociated natural gas is prohibited unless authorized for reasons of safety, emergency, testing, or the cleaning of wells. Other articles of the resolution detail conditions and requirements for flaring and venting with and without prior authorization (see sections 9 and 10 of this case study). ANP Ordinance 123/2000 establishes the technical rules for the oil and gas PAP.

Article 177 of the Federal Constitution, 1988, as modified by Constitutional Amendments 9/95, 33/11, and 49/06, establishes the federal government’s monopoly over the exploration and exploitation of Brazil’s oil and natural gas deposits. Brazil currently has three legal regimes applicable to upstream oil and gas activities:

- concession, regulated by Petroleum Law, 1997

- production sharing, regulated by Law 12351/2010

- transfer of acreage in the pre-salt zone to Petrobras, regulated by Law 12276/10, 2010.

Article 225 of the Federal Constitution, 1998, provides the main framework and provisions for environmental protection in Brazil. The most important piece of legislation is Law 6.938, the National Environmental Policy Act, 1981.

Legislative Jurisdictions

Articles 3 and 21 of the Petroleum Law, 1997, place all oil and gas activities under national jurisdiction.

Associated Gas Ownership

Articles 20 (items V and IX) and 176 of the Federal Constitution,1988 , and Article 3 of the Petroleum Law, 1997 , vest the oil and gas deposits in the territory, the continental shelf, and the exclusive economic zone in the federal government. Article 26 of the Petroleum Law, 1997, states that the concessionaire owns measured volumes of extracted oil and gas at the production measurement point, with charges related to the payment of the applicable taxes and the corresponding legal or contractual obligations. There is no difference in the treatment of oil and gas.

Gas flared and vented is subject to royalties. The Concession Agreement for Exploration and Production of Oil and Gas states that natural gas that is flared or vented should be included in the total production volume calculated for the purpose of paying royalties to the government.

Regulatory Governance and Organization

Regulatory Authority

According to Article 7 of the Petroleum Law, 1997 , the ANP under the Ministry of Mines and Energy (MME; Ministerio de Minas y Energía) is responsible for regulating all petroleum industry activities. It is responsible for formulating Brazil’s policies in the energy sector. The council comprises government representatives (including seven ministers), outside energy experts, and nongovernmental organizations. The Energy Research Office (Empresa de Pesquisa Energética [EPE]) was established by Law 10847/2004. It supports the MME’s energy policies with studies and research on energy planning, including for electricity, oil, natural gas, and biofuels. Law 7735/1989 created the Brazilian Institute of Environment and Renewable Natural Resources (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais), the administrative arm of the Brazilian Ministry of the Environment.

Regulatory Mandates and Responsibilities

The oil and gas sector is under federal jurisdiction; the ANP regulates all activities related to the industry. According to Article 8 of the Petroleum Law, 1997, the purpose of the ANP is to oversee the regulation, engagement, and inspection of economic activities in the oil, gas, and biofuel industries. Resolution 806/2020 regulates the flaring and venting of associated gas. According to Chapter 4 of Ordinance 422/2011, the Brazilian Institute of Environment and Renewable Natural Resources is responsible for environmental licensing of oil and gas activities. The institute can also impose environmental permit conditions related to flaring and venting, with a focus on the prevention and mitigation of GHG emissions.

Monitoring and Enforcement

Chapter 4 of the Petroleum Law, 1997 empowers the ANP to undertake all measures necessary to regulate, monitor, and control activities related to the oil and gas industry.

Licensing/Process Approval

Flaring or Venting without Prior Approval

Article 2 of Resolution 806/2020 defines “ordinary flares” as flaring or venting of gas that does not require prior authorization. Article 3 states that the volume of ordinary flaring or venting of natural gas carried out each month cannot be higher than that corresponding to the Associated Gas Utilization Index (Índice de Utilização de Gás Associado [IUGA]) for the same month in the approved PAP with a permitted exceedance of 15 percent. Sanctions are applied to each monthly infraction. Article 14 states that authorization is not needed in case of emergency flaring or venting. Operators should provide ANP validation of the volume of gas flared or vented during emergencies.

Article 6 states that flaring or venting associated gas does not require the ANP’s prior approval in the following cases:

- Flaring or venting of associated gas in volumes equal to or less than

- 3 percent (IUGA greater than or equal to 97 percent) of monthly offshore production of associated gas in fields in operation five years before the date of the publication of the resolution (before January 17, 2025) and 2 percent (IUGA of 98 percent or greater) in fields that start production five years or later after the date of the publication of this resolution (after January 17, 2025)

- 1.5 percent (IUGA of 98.5 percent or greater) of the monthly associated gas handled by a marine production unit for lifting oil or received from other units in volumes equal to or greater than 50 percent of the volume of gas handled

- 3 percent (IUGA of 97 percent or greater) of the monthly onshore production of associated gas.

- When the volumes of associated gas flared are greater than those approved, but the new (or revised) IUGA is equal to or greater than the one considered in the most recent approved PAP.

- Flaring of petroleum or flaring or venting of natural gas during well testing with a flow period of 72 hours or less per interval tested.

- Flaring or venting of associated gas in fields that produce a total monthly volume equal to or less than that corresponding to an average flow rate of 5,000 m³/day as long as the field does not have wells with an average flow rate above 1,500 m³/day, for which a project using associated gas should be proposed.

- Flaring or venting of associated gas produced in onshore fields or marine production units with a gas-to-oil ratio of 20 m³ of gas per m³ of crude oil or less.

- Flaring for safety reasons. For onshore production units, a limit on a maximum monthly volume of 1,000 m³/day for each pilot/flare. The offshore limit is 2,000 m³/day for each pilot, provided that such pilots are operational.

Articles 7–16 define the criteria and procedures for authorization and validation of extraordinary flares and circumstances under which extraordinary flaring and venting of associated gas are allowed without prior approval.

Authorized Flaring or Venting

Article 2 of Resolution 806/2020 defines “extraordinary flaring” as associated gas flaring and venting subject to the ANP’s prior authorization or subsequent validation. Article 3 requires the ANP’s approval of the PAP, which must include forecasts of routine gas flaring and venting and volumes flared or vented that would not be subject to royalties. Article 7 states that the ANP’s authorization of extraordinary flaring should be requested with notice of a minimum of 30 days. Articles 8–16 establish the procedures and criteria for authorization or subsequent validation of “extraordinary flaring.”

The annual production programs approved by the ANP may contain specific conditions, including those related to flaring or venting, in addition to those imposed by Resolution 806/2020. ANP Ordinance 123/2000 provides the procedures to be followed for approval. Resolution 806/2020 provides the technical criteria. Chapter 4 of Ordinance 422/2011 authorizes the Brazilian Institute of Environment and Renewable Natural Resources to set conditions for environmental licenses, including controlling emissions discharged to the atmosphere.

Development Plans

Article 44 of the Petroleum Law, 1997 requires the inclusion of associated gas use in the field development plan submitted to the ANP for approval after the declaration of commercial viability for a given project. The plan should consist of a schedule and investment estimate. Resolution 17/2015 provides guidelines for field development plans. Article 16(3) requires the submission of volumes expected for gas lift, internal consumption, re-injection, and flaring and venting, as well as mitigation plans for reducing gas flaring.

Economic Evaluation

Section 8.1.6 of ANP Ordinance 123/2000 stipulates that the PAP should include the volume of associated gas that would not be used or re-injected. The PAP must also demonstrate, based on economic evaluation, that the oil or gas production of the field would not be economically feasible if the gas so identified cannot be flared.

To reduce flaring, the production of oil and gas may be started only after the installation of a system that utilizes or re-injects any natural gas, unless the ANP grants an exception upon consideration of the economic evaluation.

Measurement and Reporting

Measurement and Reporting Requirements

ANP Joint Resolution No. 1/2013 contains the technical regulation for the measurement of oil and natural gas. According to Article 9 of Resolution 806/2020 , operators should provide the ANP with monthly production reports that include gas flaring and venting data. The report must be submitted by the 15th day of each month. Operators should report estimates of flared or vented associated gas for each of the following categories:

- safety

- scheduled maintenance

- works in progress, such as facilities under construction

- low gas production (insufficient volume of gas to be used)

- economics (associated gas whose use or re-injection would make the field uneconomic)

- venting in tanks (associated natural gas vented).

The Model Contract-Concession Agreement for Exploration and Production of Oil and Gas explicitly mentions the requirement for reporting the volumes of gas flared or vented in Section 12. Licensees should submit to the ANP a monthly report on the production of each development area or field according to the applicable laws and regulations. Gas flaring and venting of natural gas with a variation above 15 percent of the volumes authorized in the PAP must be accompanied by due justifications. The licensee’s flaring and venting of gas should be included in the total production volume to be calculated for the purpose of paying royalties to the government. In this case, the flared volumes are monitored daily through the Production Inspection System (Sistema de Fiscalizacao da Producao).

Measurement Frequency and Methods

Resolution 806/2020 requires the concessionaire to regularly measure the volume and quality of the oil or gas produced in each development area or field from the production start date, using the measurement methods, equipment, and tools established in the development plan and in the applicable laws and regulations. The specifics of the frequency of volume measurements or measurement methodology could not be identified in the sources consulted.

Engineering Estimates

No evidence regarding engineering estimates could be found in the sources consulted.

Record Keeping

No evidence regarding record-keeping requirements could be found in the sources consulted.

Data Compilation and Publishing

The ANP’s Development and Production Superintendence produces a monthly report, the “Oil and Natural Gas Production Bulletin,” which provides information on Brazilian oil and gas production, including flaring data. The most recent data are from March 2020. Reports are published on the government’s website.

Fines, Penalties, and Sanctions

Monetary Penalties

According to the ANP’s interpretation of Article 2 of Law 9847/1999 and subsequent decisions, infractions involving flaring or venting are subject to fines or nonmonetary sanctions. Article 3 states that the monetary penalty ranges from R$5,000 to R$2,000,000 (about US$960–US$3,800 as of September 2021). The ANP determines the monetary penalty for flaring or venting according to the seriousness of the infringement and the operator’s previous infraction history under ANP Ordinance 397/2018. Article 13 provides for the right to appeal.

Decree 2953/1999 sets forth the administrative procedure for applying penalties for infractions committed in activities related to the oil industry and the national supply of fuels. Administrative sanctions may take the form of fines and nonmonetary sanctions (see the next section). According to Article 26, the fine should be paid within 30 days of the date of acknowledging the infraction. Failure to pay the fine within the specified period will subject the offender to a default interest rate of 1 percent and a late payment penalty of 2 percent a month or a fraction thereof.

Section 3 of Resolution 806/2020 states that the operator is subject to a sanction each month the volume of gas flared or vented exceeds the level authorized in the most recently approved PAP. Articles 1 and 2 of Resolution 774/2019 allow operators to make the penalty payment in up to 60 monthly installments, in accordance with the conditions to be negotiated with the ANP.

Data on fines imposed by the ANP during 2011–15 are available for download on the ANP website; information on fines for flaring and venting after 2015 has not been posted. During 2011–15, 177 fines were imposed, of which 94 were for flaring gas in volumes higher than authorized. These fines totaled R$121,700,000 (about US$23 million). The fines applied from 2016 onward have been published, but there is no specific information on flaring and venting during that period.

In October 2014, the ANP fined Petrobras a total of R$6 million (about US$1.1 million as of September 2021) for flaring violations committed in the production of the onshore field of Fazenda Santa Luzia in the north of the Espirito Santo state. According to the ANP, Petrobras flared associated gas in April, May, September, October, and November 2010 in an amount higher than provided for in the Annual Production Plan. The company asked for the suspension of fines. On October 15, 2020, the courts upheld the fine imposed by the ANP. In another action, Petrobras requested the suspension of the collection of fines, totaling about R$16 million, for irregularities found in the measurement system of the Zephir I Platform in the Santos Basin. The irregularities were detected during an inspection by the ANP in March 2012.

Nonmonetary Penalties

According to the ANP’s interpretation of Article 2 of Law 9847/1999 , infractions involving flaring or venting may be subject to suspension of operation. Article 13 provides for the right to appeal.

Under Decree 2953/1999 , nonmonetary sanctions can take the form of suspension of product supply; temporary suspension, total or partial, of the facility or installation; cancellation of registration of an installation; and revocation of authorization to carry out the associated activity. Sections 1 and 2 of the decree provide administrative penalty procedures; Sections 3 and 5 describe the appeal procedures. The defendant has 15 days to present evidence to contest the charges, and the ANP has 30 days to evaluate and decide on the case. If the decision rules against the operator, a second appeal can be mounted within 10 days. The ANP director will decide on the appeal within a maximum period of 30 days, starting from the date of the submission of the appeal.

Enabling Framework

Performance Requirements

No evidence regarding performance requirements could be found in the sources consulted.

Fiscal and Emission Reduction Incentives

According to Law 9847/1999, the volume of gas flared under the responsibility of the concessionaire will be included in the total volume of production used for calculating royalties. The royalty rate is typically 10 percent but can be as low as 5 or as high as 15 percent. Royalties on oil and gas production are fully tax-deductible.

Use of Market-Based Principles

No evidence regarding the use of market-based principles to reduce flaring, venting, or associated emissions could be found in the sources consulted.

Negotiated Agreements between the Public and the Private Sector

The main instruments for controlling gas flaring and venting in Brazil are the field development plan, the PAP, the monthly production reports, and the Terms of Commitment. The Terms of Commitment are agreements for the reduction of volumes flared over the medium term that contain targets for the use of associated gas and action plans that guarantee compliance with them. Three such agreements have been signed, two with Petrobras and one with Chevron.

Important initiatives on flaring reduction in Brazil are Petrobras’ 2009 Gas Optimization Program and the signing of the second Term of Commitment between Petrobras and the regulator, as a direct consequence of the finding that the volume of gas flared exceeded the limits allowed by ANP’s Ordinance 249/2000. Under the Adjustment Program to Reduce Natural Gas Flaring in the Campos Basin, Petrobras reduced emissions by more than 40 percent between 2009 and 2019, despite increasing oil production. Since then, the ANP has been restricting authorized volumes of extraordinary flaring of natural gas. Petrobras has committed to eliminating the absolute growth of its operational emissions by 2025 and eliminating routine flaring by 2030.

The company has developed technologies to capture and re-inject carbon dioxide into the oil fields, especially in the pre-salt area. The company has also invested in research through its association with the Oil and Gas Climate Initiative. Petrobras has also released its second climate supplement, outlining its climate commitments and explicitly supporting the Task Force on Climate-Related Financial Disclosures.

Interplay with Midstream and Downstream Regulatory Framework

Petrobras was instrumental in creating Brazil’s gas sector, but the company’s control over the industry discouraged new investors from entering the sector and constrained its growth. The New Gas Market is a government program intended to create an open and competitive natural gas market in Brazil. It aims to make the most efficient use of existing infrastructures, attract new investments, and promote competition in the natural gas market. The program has reduced Petrobras’ market power and end-user prices.

Petrobras held a monopoly in Brazil’s oil and gas industry until 1995, when Constitutional Amendment No. 9 was approved, making it possible to introduce competition. The Petroleum Law, 1997 , implements the constitutional amendment. In the case of natural gas, however, it did not promote a significant change in the market structure, with Petrobras remaining the dominant player and a monopolist by default. Law 11.909/2009, Gas Law , was adopted to address issues specific to the natural gas industry and attract new investments. It did not achieve the desired objectives.

Resolution 16/2019 established guidelines for an energy policy aimed at promoting competition in the natural gas market and reducing the influence of Petrobras over the market. A Term of Commitment of Assignment (Termo de Compromisso de Cessão) was signed between Brazil’s competition authority and Petrobras. It ended the de facto monopoly of Petrobras. Tax amendments were made providing incentives for gas pipeline transport (Ajuste SINIEF nº 03/2018 and Ajuste SINIEF nº 17/2019).

One of the objectives of Resolution 16/2019 was to improve the recovery of associated gas in the pre-salt basin. The discovery of pre-salt gas could double the potential of natural gas supply in Brazil in the next 15 years. However, pre-salt gas fields are more than 1,500 meters below sea level and about 300 kilometers from the coast. In addition, the pre-salt gas is rich in carbon dioxide, the release of which would increase GHG emissions substantially. The delivery of associated gas will require significant investments in capture and gas treatment infrastructure and offshore pipelines.