Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

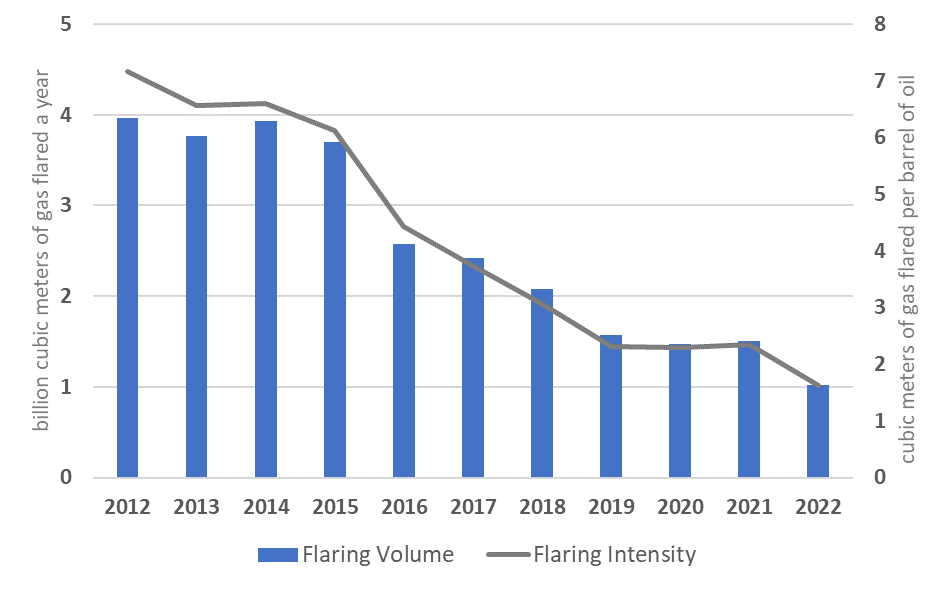

Kazakhstan has achieved a remarkable reduction in both the volume of gas flared and the flaring intensity in recent years. Between 2012 and 2022, both metrics fell by more than 70 percent. The volume flared fell from 4.0 billion to 1.0 cubic meters (m3) between 2012 and 2022, and the flaring intensity fell at an even faster rate, from 7.2 m3 to 1.6 m3 per barrel of crude oil produced (Figure 4). Oil production increased by 14 percent during this period. There were 93 individual flare sites in the most recent flare count, conducted in 2022.

Figure 4 Gas flaring volume and intensity in Kazakhstan, 2012–22

In 2016, the government and the national oil company, KazMunayGas, endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. Kazakhstan also participates in the Global Methane Initiative. In December 2016, Kazakhstan submitted its first Nationally Determined Contribution (NDC) to the United Nations Framework Convention on Climate Change. It set an unconditional target of a 15 percent reduction in greenhouse gas (GHG) emissions from the 1990 level by the end of 2030. The NDC also includes a reduction target of 25 percent as a conditional contribution. The NDC does not mention flaring and venting. In late 2022, the European Bank for Reconstruction and Development (EBRD) and the Minister of Ecology, Geology and Natural Resources of Kazakhstan signed a memorandum of understanding to develop a National Methane Emissions Inventory and Reduction Program. The EBRD already supports the Fugitive Methane Emissions and Carbon Intensity Reduction Program, which specifically targets natural gas infrastructure.

Kazakhstan has prohibited flaring associated gas since the mid-2000s, with certain exceptions. The Law on Subsoil and Subsoil Use, 2017, prohibits most flaring and vests the ownership of associated gas in the state unless an upstream contract grants ownership rights to the licensee. The Law on Gas and Gas Supply, 2012, promotes greater use of natural gas in the Kazakh economy and introduces the state’s preferential right to purchase gas from licensees.

Previously, flaring emissions were regulated under the Environmental Code, 2007, which was superseded in July 2021 by the Environmental Code, 2021. Kazakhstan established the first GHG emissions trading system (ETS) in Asia in 2013. Updates to the Environmental Code guided different phases of the ETS market. There is no explicit mention of venting in either the subsoil or environmental laws, but the GHG ETS began covering methane emissions in 2021.

KazMunayGas is a partner in the largest upstream projects—including Tengiz, Kashagan, and Karachaganak. Flaring from these projects has been reduced, in some cases significantly. For example, the operator of the Tengiz field, Tengizchevroil, reduced flaring emissions by more than 94 percent within a decade via several capital projects, including an investment in a four-year gas utilization project to eliminate routine flaring. The project’s success was recognized with an Excellence in Flaring Reduction Award at the 2012 Global Gas Flaring Reduction forum.

Targets and Limits

No evidence regarding overarching targets and limits could be found in the sources consulted. However, Article 146 of the Law on Subsoil and Subsoil Use, 2017 , prohibits the flaring of raw gas. According to Article 147, operators must “carry out activities aimed at minimizing the volume of raw gas flaring.” The Ministry of Energy calculates permissible volumes of gas that can be flared (see section 7 of this case study). Field development plans must include a section detailing how raw gas will be processed and utilized.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

Kazakhstan first banned flaring in the mid-2000s, when the government amended the statutes that governed upstream oil and gas activities (for example, the Petroleum Law, 1995); asked operators to cease flaring; and prohibited new developments without associated gas utilization plans. The Law on Subsoil and Subsoil Use, 2017 , prohibits the flaring of associated gas, with certain exceptions. The law superseded the 2010 version. It includes the same flaring restrictions but adds some clarifications.

The Environmental Code, 2021 , requires entities responsible for gaseous emissions to obtain a permit and introduces the concept of an integrated environmental permit (see section 13 of this case study). In 2011, GHG regulations were added to the Environmental Code. Relevant articles have been updated as necessary to set the new quotas for phases of the national ETS regime.

Legislative Jurisdictions

The flaring of associated gas and the emissions associated with flaring are regulated primarily at the national level, but local authorities have jurisdiction over environmental regulation (Article 28 of the Environment Code, 2021). According to the Environmental Code, 2021 , local executive bodies, in agreement with the national environmental regulator, have the power to “establish stricter environmental standards” for air emissions if local conditions warrant them (Article 200). Local executive bodies and the regional subdivision of the national environmental regulator can introduce temporary measures during unfavorable meteorological conditions or increased urban air pollution, including the shutting down of facilities (Article 210). These and other powers granted to local executive bodies cover stationary and mobile sources of air emissions, including the combustion of raw gas in flares (Article 202). Taxes on emissions and penalties for violations are paid mostly to local governments.

Associated Gas Ownership

Kazakhstan uses concessions to grant companies the right to explore and exploit hydrocarbons, except for legacy production-sharing contracts (signed before January 1, 2009). Article 147 of the Law on Subsoil and Subsoil Use, 2017 , states that companies must minimize flaring of associated gas, and that associated gas is “the property of the state” unless an upstream contract assigns gas rights to the licensee for self-use (see section 12 of this case study). The Law on Gas and Gas Supply, 2012 , refers to the 2010 version of the subsoil law. It reiterates the principle of the state’s ownership of associated gas. Article 15 of the Law on Gas and Gas Supply, 2012, gives the state the right to purchase gas that is not authorized for self-use.

Regulatory Governance and Organization

Regulatory Authority

The Ministry of Energy is the “authorized body” (regulator) of hydrocarbons. The Ministry’s Department of State Control in the Sphere of Hydrocarbons and Subsoil Use (DSCHS) regulates flaring. The Ministry of Ecology, Geology, and Natural Resources (MEGNR) is the environmental regulator and has jurisdiction over flaring emissions. Territorial divisions of MEGNR and local executive bodies play roles in implementing environmental regulations.

Regulatory Mandates and Responsibilities

According to regulations defining its objectives and functions, the DSCHS, on behalf of the Ministry of Energy, is responsible for developing rules for issuing flaring permits and ensuring their approval and registration. The Ministry of Energy is responsible for, and the DSCHS participates in, estimating permissible volumes of raw gas flaring, measurement, and calculation standards, as stipulated in Article 146 of the Law on Subsoil and Subsoil Use, 2017 . These standards are reflected in field development plans and environmental impact assessments. The standards can be revised in response to technological developments or individual needs of fields. MEGNR is responsible for conducting such assessments or approving those conducted by licensed companies. It is also responsible for issuing environmental permits, including those for emissions from flares. Emissions from flares should be within the volumes allowed in flare permits. If they are not, environmental regulations prevail and penalties are to be levied accordingly.

Monitoring and Enforcement

The DSCHS is responsible for monitoring and enforcing compliance with the oil and gas industry permits it issues. It can conduct scheduled or unscheduled inspections, enlist specialists from state bodies and other organizations as well as foreign and local experts, and request any document and data deemed necessary for ensuring compliance. The DSCHS coordinates with two interregional departments of the Ministry of Energy: the Western Interregional Department of State Inspection in the Oil and Gas Complex and the Southern Interregional Department of State Inspection in the Oil and Gas Complex.

MEGNR has the authority to inspect facilities for compliance with environmental permits. If a facility exceeds its permissible emissions levels from flares, MEGNR has the authority to penalize violations of environmental permits.

Licensing/Process Approval

Flaring or Venting without Prior Approval

According to Article 146 of the Law on Subsoil and Subsoil Use, 2017 , a permit is not required for flaring under emergency conditions. The operator must report the reasons for and volumes of flaring to the Ministry of Energy and MEGNR within 10 days. An emergency is defined as a threat to the lives of personnel, public health, or the environment.

Authorized Flaring or Venting

According to Article 146 of the Law on Subsoil and Subsoil Use, 2017 , flaring is allowed during emergencies, well testing, trial operations of a field, and if it is unavoidable on technical grounds. Except in an emergency, flaring under all other circumstances requires a permit from the Ministry of Energy. Applications for a permit to flare raw gas can be submitted online.

There are special considerations for the northern Caspian Sea region. For example, according to Article 274 of the Environmental Code, 2021 , flaring of liquids during well operations is prohibited and “flaring of hydrocarbons during well testing should be minimized using the best available technology, which is the safest for the environment.” The best available technology is identified during the process of the environmental impact assessment. Such flaring is allowed “only under favorable weather conditions conducive to the dispersion of the smoke plume, while the design of the flare units must ensure the complete combustion of hydrocarbons.”

Development Plans

Article 147 of the Law on Subsoil and Subsoil Use, 2017 , requires operators to minimize the volume of raw gas flaring and field development plans to include a section on raw gas processing or utilization. Field development plans are reviewed by the Central Commission for Exploration and Development “with the involvement of independent experts with special knowledge in the field of geology and development and not interested in the results of the examination,” as stipulated in Article 140. Articles 134–143 detail the necessary project documents and the review process. The Ministry of Energy’s Department of Subsoil Use organizes an independent review of project documents and development plans. According to Article 147, the gas-processing program is to be updated every three years. Annual reports on the implementation of the program must be submitted to the Ministry of Energy.

Economic Evaluation

Article 147 of the Law on Subsoil and Subsoil Use, 2017 , prohibits the extraction of hydrocarbons without processing all raw gas. However, the law provides for several exceptions, all of which must be outlined in the field development plan. Article 146 provides exceptions under which flaring is permitted; Article 147 adds several others. The field development plan may include the operator’s own use of the gas or its sale to other parties. If these options cannot be justified economically, the field development plan may include re-injection for storage or enhanced oil recovery as long as other methods are ineffective in maintaining reservoir pressure and re-injection does not harm the environment.

There are also regional considerations. For example, Article 274 of the Environmental Code, 2021 , prohibits the injection of associated gas for enhanced oil recovery in excess of the design parameters and volumes approved in the field development plan in the northern Caspian Sea region. These plans must be reviewed by an expert panel organized by the Department of Subsoil Use of the Ministry of Energy before being considered by the latter for approval.

Measurement and Reporting

Measurement and Reporting Requirements

Flaring during oil and gas operations must be measured and reported to the Ministry of Energy. Article 76 of the Law on Subsoil and Subsoil Use, 2017 , requires licensees to report on their activities covered under the permits issued by the Ministry of Energy. These reports may be periodic or one-time in nature. The Ministry of Energy develops standards for permissible raw gas flaring volumes, measurement, and calculation in accordance with Article 146. These standards should be observed in all reporting. Order 164, 2018, is the most recent ministerial order approving the methodology for calculating flare volumes.

Article 203 of the Environmental Code, 2021 , details monitoring requirements for emissions, including from flares. Environmental permits, based on the environmental impact assessments, require the measurement of emissions to ensure compliance. They should also include a list of acceptable metering methodologies or, if metering is not feasible, allowed calculation methodologies. Article 186 states that monitoring at Category I facilities, which includes upstream oil and gas, “should include the use of an automated system for monitoring emissions into the environment.” Facilities operating before July 1, 2021, have until January 1, 2023, to install automated systems for monitoring emissions (Article 418). The data from automated emissions monitoring are considered primary data and are to be included in the new “National Bank of Data on the State of the Environment and Natural Resources of the Republic of Kazakhstan” (Articles 155 and 156). MEGNR will use these data to monitor compliance with environmental permits with or without a site visit (Article 174).

The Environmental Code, 2021, introduces the concept of the integrated environmental permit, which is mandatory for Category I facilities (Article 111) starting January 1, 2025, for facilities commissioned on or after July 1, 2021 (Article 418). The permit is granted by MEGNR, in collaboration with other state entities if appropriate. Companies in Category I still need to conduct an environmental impact assessment. Article 113 defines the best available techniques, their purpose, and criteria for determining such techniques across sectors listed in Appendix 3. Techniques are intended to cover technologies as well as processes, practices, and approaches to designing, building, operating, maintaining, and decommissioning facilities. Article 113 establishes the Bureau of Best Available Technologies, falling within MEGNR, and outlines its tasks. The bureau will develop guidelines on the best techniques for all areas by July 1, 2023 (Article 418).

Measurement Frequency and Methods

Ministry of Energy Order 203, 2018, approves reporting rules for oil and gas as well as mineral operations. These rules are represented in annex tables and are developed in accordance with Article 132 of the Law on Subsoil and Subsoil Use, 2017 , which lists the reports oil and gas licensees must submit. Article 145 calls for a unified state system of subsoil use management (a digital database). Article 16 of the Law on State Statistics, 2010, gives administrative bodies the right to acquire statistical information. Annex 24 of Order 203 requires daily reporting of associated gas production, and Annex 26 requires monthly reporting of volumes of associated and natural gas used, lost, marketed, re-injected, or flared.

Engineering Estimates

No details relating to engineering estimates could be identified in the relevant regulation, but industry reports suggest that companies report flare volumes based on meter readings or engineering estimates. According to one paper on flare reduction at the Kashagan field, operators have developed methodologies to estimate flare volumes as a backup to meter data. For emissions from flares, metered or calculated estimates are accepted, but Environmental Code, 2021 requires mandatory automated emissions monitoring for Category I facilities going forward.

Record Keeping

No evidence regarding record-keeping requirements could be found in the sources consulted. However, industry reports suggest that operators must keep a log of metered flare volumes or estimates based on approved calculation methods. Flare meters collect data on continuous and intermittent flaring at the flare stack. The data should be entered in the unified state system of subsoil use management along with operational data. All flaring must be classified by location (onshore, offshore); duration, type of gas (sweet or sour); composition; cause of flaring (planned, unplanned); and source (tag number of the equipment, which is often a pressure relief valve).

Data Compilation and Publishing

No evidence regarding data compilation and publishing could be found in the sources consulted. However, the annual reports of KazMunayGas include raw gas flaring volumes from KazMunayGas operations for the last several years.

Fines, Penalties, and Sanctions

Monetary Penalties

Both hydrocarbon and environmental regulators can impose penalties, the former for violating a flaring permit and the latter for violating an emissions permit. Penalties for violation of emission permits are more common.

Article 175 of the Environmental Code, 2021 , authorizes MEGNR to assign daily monetary penalties. Interest is charged if payments are delayed or the offending party does not bring the operation into compliance within the specified time. According to Article 356 of the Code on Administrative Infractions, 2014, failure to perform the environmental requirements during subsoil use entails fines, the level of which depends on the size and income of the operator. In addition, environmental taxes are paid on all emissions, even when emissions are below the limits granted in permits. The penalties and taxes for stationary sources are paid to the local government at the location of the emission source, according to Article 577 of the Tax Code, 2017.

Article 133 of the Law on Subsoil and Subsoil Use, 2017 , authorizes the Ministry of Energy to penalize violators of subsoil use contract terms unless operators bring the operation into compliance within the designated period (up to six months depending on the violation). Subsoil use contracts capture approved project documents such as field development plans that must have gas utilization scope and flares. Paying penalties does not negate the obligation to bring the operation into compliance. The operator has the right to ask for an extension of the specified period for compliance, which must be approved by the Ministry of Energy after an expert review.

According to Article 356 of the Code on Administrative Infractions, 2014, flaring without a permit, except when allowed by law, or violation of permit conditions “shall entail a fine on subjects of small entrepreneurship in amount of 250, on subjects of medium entrepreneurship in the amount of 500, on subjects of large entrepreneurship in the amount of 2,000 monthly calculation indices.” Article 356 also lists penalties for hydrocarbon extraction without using and processing raw gas, violations of requirements in approved project documents, and environmental requirements. No evidence of penalties by the Ministry of Energy under these articles for violation of flare permits could be found.

Nonmonetary Penalties

Article 106 of the Law on Subsoil and Subsoil Use, 2017 , provides for early termination of the subsoil use contract under certain conditions, including violations of the contract terms. The operator can dispute the early termination decision in court within two months of receiving the notice. No case of contract termination based on a flare permit violation could be identified.

Enabling Framework

Performance Requirements

Article 202 of the Environmental Code, 2021 , details the standards for permissible emissions. It also clarifies that these standards apply to all flares other than those deemed technologically unavoidable by the regulator, the Ministry of Energy. According to Article 200, local executive bodies have the power to “establish stricter environmental standards” for air emissions if local conditions warrant it. According to Article 39, emissions standards for facilities with an integrated environmental permit will be established based on the best available techniques as determined by the Bureau of Best Available Technologies (see section 13 of this case study).

Fiscal and Emission Reduction Incentives

According to Article 127 of the Environmental Code, 2021 , emission taxes are calculated using base levies for various emissions, including those from flaring, provided in tax laws. For example, according to Article 576 of the Tax Code, 2017 , base tax rates for emissions from flaring are 20–278 times as large as the same emissions from other stationary sources. Paragraph 8 of Article 576 states that local authorities may increase the tax rates up to 200 percent of the base rate, except for emissions from flares, which can be increased to more than 200 percent of the base rate.

Recent changes to the Tax Code align it with the Environmental Code, 2021. According to Article 575 of Law No. 402-VI, 2021, the base tax rates for emissions from stationary sources will be doubled from January 2025, and emissions from flaring will be assessed at the same rate as stationary sources. Article 130 of the Environmental Code, 2021, provides tax relief to facilities that obtain an integrated environmental permit through the adoption of the best available techniques (see section 13 of this case study). Penalties will be heavier for facilities that do not adopt the best available techniques.

Use of Market-Based Principles

Kazakhstan initiated the first ETS in Asia in 2013. Phase II covered 2014 and 2015. Phase III was delayed until the establishment, in 2018, of an online platform for monitoring, reporting, and verifying GHG emissions. The Environmental Code was periodically updated to include GHG quotas and related obligations and standards to assist with the evolution of the ETS market. Regulations on GHG emissions published in March 2022 provide further details. Only carbon dioxide emissions are included in the ETS market.

Operators of oil and gas installations with annual GHG emissions of more than 20,000 tonnes of carbon dioxide equivalent (tCO2e) must obtain quotas. The penalty for noncompliance was waived in 2013 and 2014, and was about 5 monthly standard units or US$37.5/tCO2e in 2022. Operators of installations with emissions of 10,000–20,000 tCO2e a year must report emissions annually, although they are not required to participate in the ETS. The average 2022 price was about US$1.22 per tCO2e. Under the National Allocation Plan 2022–2025, the cap is 163.7 million tCO2e for 2023, 161.2 million tCO2e for 2024, and 158.8 million tCO2e for 2025.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

Interplay with Midstream and Downstream Regulatory Framework

The Law on Gas and Gas Supply, 2012 , supports the government’s policy of increasing gas use across the country to avoid wasting the country’s natural resources and replace coal and other fuels with higher emissions. The national gas system operator KazTransGas, wholly owned by KazMunayGas, is also trying to reduce fugitive emissions across its transmission and distribution network. Since 2018, KazTransGas has used remote methane sensing, which identified 3,963 leaks by the end of 2020. Fixing these leaks will reduce methane emissions and avoid the waste of gas.

Article 15 of the Law on Gas and Gas Supply, 2012, establishes the preferential rights of the state to purchase raw or processed (“commercial”) gas assigned to the operator under the upstream contract. KazTransGas is responsible for procuring the gas from upstream operators. Article 15 stipulates that the raw gas price can include the cost of recovering raw gas, the cost of delivering it to a location where KazTransGas can take possession, and a profit margin of no more than 10 percent. The price of commercial gas can also include the cost of processing.

The National Energy Report, 2019, of the Kazakhstan Association of Oil, Gas, and Energy Sector Organizations (Kazenergy) suggests that the price paid by KazTransGas has not been sufficient to cover “the costs associated with recovering associated sour wet gas that must be gathered, processed, and transported to an injection point.” However, the price has been sufficient to cover the cost of delivering “shallow dry gas” to KazTransGas. According to the KazMunayGas 2020 Annual Report , five operating companies, in which KazMunayGas is a partner, sell their gas to KazTransGas under Article 15 of the Law on Gas and Gas Supply, 2012, and five others, including the Tengiz, Karachaganak, and Kashagan operations, sell gas directly to domestic and export markets or use it for re-injection or meeting their own heat and electricity needs.

The 2020 Annual Report of KazTransGas acknowledges the need to increase wholesale prices to ensure the commerciality of domestic gas sales. It refers to a ministerial meeting in August 2020 that called for an annual increase of 15 percent between 2021 and 2026. Although domestic gas sales are twice as large as export volumes, revenues from domestic sales accounted for only 6 percent of revenues in 2018, mainly because regulated prices of gas delivered to customers have been kept artificially low. Phased increases of transport tariffs and retail prices, possibly based on netback pricing, are part of the strategic objectives of KazTransGas. Reforming gas pricing and sending the right price signals across the natural gas value chain are expected to provide incentives to reduce flaring further by offering a commercially viable alternative to upstream operators and serving the government’s gasification policy efficiently