Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

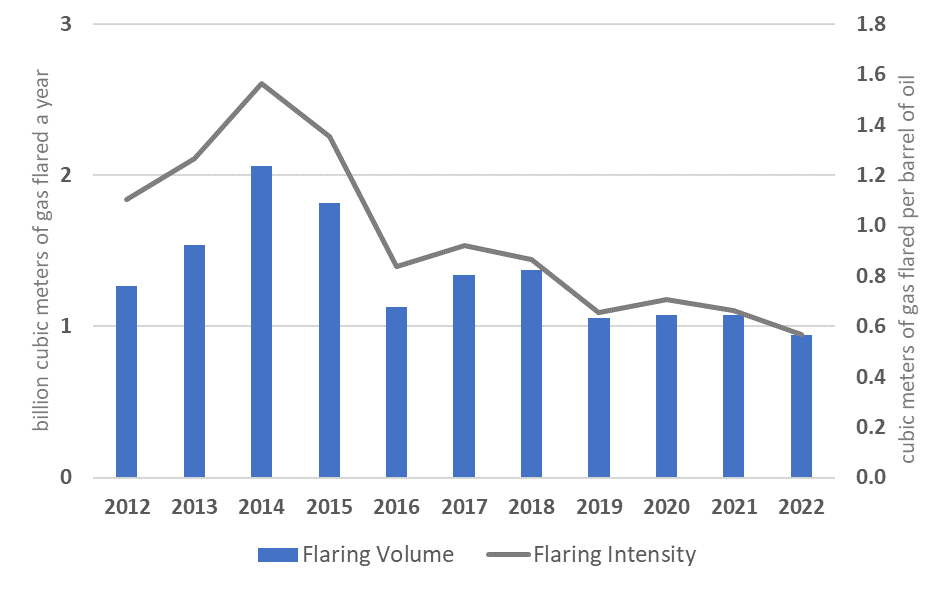

The volume of gas flared in Canada increased from 1.3 billion cubic meters (bcm) in 2012 to 2.1 bcm in 2014 before falling to 0.9 bcm in 2022 (Figure 1). During this period, oil production rose by 45 percent, but associated emissions were more than offset by the decline in flaring intensity. There were 525 individual flare sites in the most recent count, conducted in 2022.

Figure 1. Gas flaring volume and intensity in Canada, 2012–22

Canada has considerable onshore and offshore resources. It produced 6 percent of the world’s crude oil and 4 percent of natural gas in 2019. Alberta, Saskatchewan, and offshore east coast sites accounted for about 50 percent, 30 percent, and 15 percent of Canada’s oil production, respectively. The growth of crude oil production since 2010 can be attributed mainly to increased output from the oil sands in Alberta. Natural gas production is concentrated in Alberta (nearly 70 percent) and British Columbia (nearly 30 percent). The great majority of oil and gas production occurs on state and private land, with the rest coming from federal and tribal lands.

In 2016, Canada endorsed the World Bank’s Zero Routine Flaring by 2030 initiative. It also participates in the Global Methane Initiative, the Global Methane Pledge, and the Climate and Clean Air Coalition. In July 2021, Canada submitted an updated Nationally Determined Contribution (NDC) under the United Nations Framework Convention on Climate Change that commits it to reducing GHG emissions by 40-45 percent below 2005 levels by 2030, raising the level of ambition substantially from the original NDC in 2016. There is an increased focus on reducing methane emissions from the oil and gas sector. Canada’s NDC outlines methane initiatives in individual provinces (see the case studies on Alberta, British Columbia, and Saskatchewan). The updated NDC is consistent with the federal government’s pledge of Canada’s reaching net-zero emissions economy-wide by 2050.

The country’s GHG emissions from the oil and gas sector have been increasing for several decades. However, nationwide emissions have stabilized since the mid-2000s, thanks to the replacement of coal-fired power generation with gas-fired generation and renewable energy. With the Pan-Canadian Framework on Clean Growth and Climate Change, 2016, Canada committed to reducing methane emissions from the oil and gas industry by 40–45 percent by 2025. In 2018, Environment and Climate Change Canada (ECCC), a Canadian government agency, published Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66. In November 2022, the Government of Canada proposed to amend these regulations to achieve at least a 75 percent reduction in methane emissions from the oil and gas industry by 2030 relative to 2012.

Targets and Limits

The Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66, last amended on January 1, 2023, contain standards for extraction, primary processing, long-distance transport, and storage. The regulations apply to facilities producing or receiving more than 60,000 m³ annually of hydrocarbon gas, which includes methane and certain volatile organic compounds. Upstream oil and gas facilities are required to take the following actions, among others:

- Limit vented volumes to 15,000 m³ a year.

- Implement leak detection and repair, starting in 2020. Regular inspections will be required three times a year, and detected leaks are to be repaired within 30 days unless the facility is required to be shut down, in which case an action plan must be prepared and implemented.

- Conserve or flare gas instead of venting, starting in 2020.

In many instances, but especially in technical matters such as the measurement of gas volumes flared or vented, these federal regulations defer to provincial flaring and venting rules and emissions limits, which provincial regulators implement. Provincial emission limits must meet or exceed federal targets.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

The Canada Oil and Gas Drilling and Production Regulations, 2009, ban flaring and venting unless the federal energy regulator permits them or they are necessary because of an emergency. The Canada Oil and Gas Operations Act, 1999, governs the exploration, production, processing, and transport of oil and gas in marine areas controlled by the federal government. Provincial governments have specific legislation governing the exploration and production of oil and natural gas as well as flaring and venting.

The Canadian Environmental Protection Act, 1999, regulates pollution prevention and waste management in matters of interprovincial or international application. Particularly relevant for flaring and venting from oil and gas operations are the Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66 . Provinces can choose to adopt these regulations or draft their own to meet or exceed the federal targets. Canada’s three major oil and gas provinces—Alberta, Saskatchewan, and British Columbia—have written their own rules.

The Offshore Waste Treatment Guidelines, 2010, help operators manage waste material associated with petroleum drilling and production in offshore areas. Two agreements between the federal and provincial governments—the Canada–Newfoundland and Labrador Atlantic Accord Implementation Act, 1987, and the Canada–Nova Scotia Offshore Petroleum Resources Accord Implementation Act, 1986—established two regulatory boards, the Canada-Newfoundland and Labrador Offshore Petroleum Board and the Canada-Nova Scotia Offshore Petroleum Board.

The agreements also formalized principles of shared management of offshore oil and gas resources and revenue sharing from previous agreements, such as The Atlantic Accord–Memorandum of Agreement between the Government of Canada and the Government of Newfoundland and Labrador on Offshore Oil and Gas Resource Management and Revenue Sharing, 1985, and the Canada–Nova Scotia Offshore Petroleum Resources Accord Implementation Act, 1986.

Many of the federal regulations have been adopted by Newfoundland, Labrador, and Nova Scotia. Examples include the following:

- Canada–Newfoundland and Labrador Offshore Petroleum Administrative Monetary Penalties Regulations, 2016

- Newfoundland Offshore Petroleum Drilling and Production Regulations, 2009

- Nova Scotia Offshore Petroleum Drilling and Production Regulations, 2009

- Canada-Nova Scotia Offshore Petroleum Administrative Monetary Penalties Regulations, 1987.

Legislative Jurisdictions

Canada’s federal and provincial governments share jurisdiction over energy and environmental policy and the legal and regulatory framework for upstream, midstream, and downstream operations. The provincial authorities enforce regulations and standard operating procedures for managing flaring and venting activities as well as reporting emissions (see the case studies on Alberta, British Columbia, and Saskatchewan).

Associated Gas Ownership

The ownership of oil and gas resources is split between the provincial government, the federal government, private freehold owners, and First Nations. Since 1887, the usual practice has been to reserve mineral rights in the granting of land. The Canada Petroleum Resources Act, 1985, governs the lease of federally owned oil and gas rights on “frontier lands,” including the “territorial sea” (12 nautical miles beyond the low water mark of the outer coastline) and the “continental shelf” (beyond the territorial sea). Under the act, subsurface oil and gas rights in unexplored areas are issued during a public call for bids, and the successful oil and gas company must pay royalties to the federal government. The rights to explore for, develop, and produce oil and gas, including associated gas, are then transferred to participants through licenses.

Regulatory Governance and Organization

Regulatory Authority

The Canada Energy Regulator (CER) was formed under the Canadian Energy Regulator Act, 2019, replacing the National Energy Board. It regulates the Northwest Territories, Nunavut and Sable Island, submarine areas not within a province in the internal waters of Canada, and the territorial sea or continental shelf of Canada, as defined in the Canada Oil and Gas Operations Act, 1999. The act provides a clear separation between the operational and adjudicative functions of the regulator.

The Canada–Newfoundland and Labrador Offshore Petroleum Board is an independent agency that regulates petroleum-related offshore activities. The Newfoundland and Labrador Department of Natural Resources part of the provincial government, regulates onshore petroleum-related activities. The Canada–Nova Scotia Offshore Petroleum Board regulates oil and gas activities in the Canada–Nova Scotia offshore area. The Canada–Newfoundland and Labrador Offshore Petroleum Board and the Canada–Nova Scotia Offshore Petroleum Board jointly regulate oil production off the coast of the maritime provinces and set limits on the volumes of gas flared in offshore installations in their respective jurisdictions.

Canada’s constitution grants exclusive authority to the provinces to regulate mineral development within their boundaries. The major producing provinces have independent oil and gas regulators. Federal and provincial (as well as territorial and indigenous) governments share authority over environmental matters. Each province has its own environmental laws.

Regulatory Mandates and Responsibilities

The mandate, roles, and responsibilities of the CER include monitoring the companies operating oil and gas pipelines that cross a national, provincial or territorial border, and overseeing oil and gas exploration and activities not otherwise regulated. The ECCC reports to the federal government’s minister of the environment and is the lead environmental federal agency. The department delivers its mandate through acts and regulations, such as the Canadian Environmental Protection Act, 1999 . It sets the national ambient objectives for different air pollutants, including those from flaring and venting.

Depending on the jurisdictional and environmental nature of the oil and gas project, an environmental assessment may be required by the provincial government, the federal government, or both per the Impact Assessment Act, 2019. Each province has its own environmental permit regime, with the provincial regulator issuing these permits. Generally, approvals are required if any substance is released that could harm the environment.

Monitoring and Enforcement

The CER has powers to enforce regulatory compliance. It can conduct audits and inspections and has various enforcement powers, including the notification of noncompliance, the issuance of inspection orders and warnings, the imposition of administrative penalties, and prosecution. All of these measures are typically applied in relation to the severity of the violation and can be escalated if violators do not take correction actions as ordered by the CER. Provincial regulators have monitoring and enforcement powers that are more directly applicable to oil and gas operations in their provinces.

Licensing/Process Approval

Flaring or Venting without Prior Approval

The definition of “waste” in the Canada Oil and Gas Drilling and Production Regulations, 2009 , includes gas flared or vented when it could have been economically recovered and processed or injected into an underground reservoir. Section 67 states that no operator should flare or vent gas unless an emergency requires it to do so. The CER must be notified in the daily drilling report, daily production report, or any other written or electronic form. The notification should include the volume of flared or vented gas. The same provisions can be found in the Newfoundland Offshore Petroleum Drilling and Production Regulations, 2009 , and the Nova Scotia Offshore Petroleum Drilling and Production Regulations, 2009 .

Section 48 of the Processing Plant Regulations requires companies to report to the CER within one week of any flaring of hydrocarbon gas occurrence or a by-product of the processing of hydrocarbon gas that occurs as a result of an emergency. Section 6 of the CER Event Reporting Guidelines, 2018, defines an emergency as any situation in which emergency or contingency procedures, such as process upsets because of automated or manual emergency shutdowns, were used. Also reportable are flaring events that may have a significant adverse effect on property, the environment, or safety. Companies are not required to report nonroutine flaring, such as that resulting from regulator-required maintenance. Provincial regulators have more specific guidelines on flaring and venting that do not require permits (see the case studies on Alberta, British Columbia, and Saskatchewan).

Authorized Flaring or Venting

Section 5 of the Canada Oil and Gas Drilling and Production Regulations, 2009 (“Management System, Application for Authorization and Well Approvals”; see footnote 8), requires that the application for authorization be accompanied by information about any proposed flaring or venting of gas. This information should include the rationale, rate, quantity, and duration of the flaring or venting. Provincial regulators have more specific guidelines on applying for and obtaining flaring and venting authorizations.

Development Plans

Development plans are required and published on the Canada–Newfoundland and Labrador Offshore Petroleum Board website. An example is the public review of the Hebron Development Plan Application.

Economic Evaluation

No evidence regarding economic evaluations by the federal government could be found in the sources consulted. However, provincial regulators consider the economic assessment of options to prevent or reduce flaring and venting.

Measurement and Reporting

Measurement and Reporting Requirements

Part 7 of the Canada Oil and Gas Drilling and Production Regulations, 2009 (“Measurements Flow and Volume”; see footnote 8), states that unless otherwise included in the approval, the operator should ensure the rate of flow and volume of any produced fluid that enters, leaves, is used, or is flared, vented, burned (incinerated)—or otherwise disposed of—are measured and recorded. This requirement encompasses any oil storage tanks, treatment facilities, or processing plants. The Newfoundland Offshore Petroleum Drilling and Production Regulations, 2009 , and the Nova Scotia Offshore Petroleum Drilling and Production Regulations, 2009 , have similar provisions.

The CER Event Reporting Guidelines, 2018 , require operators to submit an annual production report covering the previous year no later than March 31 of each year. This report must include details on the production forecast and gas conservation as well as efforts to maximize recovery and reduce costs. The report must also demonstrate how the operator manages or intends to manage the resource and avoid waste.

An annual environmental report must also be submitted. This report should include a summary of any incidents that may have had an environmental impact, discharges that had occurred and the waste material produced, and a discussion of the efforts undertaken to reduce pollution and waste material. The ECCC first developed the GHG reporting program in 2004. It has updated reporting and GHG quantification requirements several times. Compliance with the annual reporting of GHG is mandatory. All facilities emitting more than 10,000 tonnes of carbon dioxide equivalent (tCO2e) in a given year must submit a report on their GHG emissions by June 1 of the following year. Facilities emitting less than the threshold can report voluntarily.

The Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66 include monthly reporting requirements to improve emissions estimates. They include inventories of emitting components at upstream facilities; reports on volumes of gas vented, flared, and delivered off-site; and results of leak-detection-and-repair inspections and monitoring.

Measurement Frequency and Methods

Under Sections 67 and 79 of the Canada Oil and Gas Drilling and Production Regulations, 2009, flows and volumes are reported through daily drilling and production reports. In an emergency, the CER should be notified of the volume of gas flared or vented in the daily drilling report, daily production report, or in any other written or electronic form as soon as the circumstances permit. Provincial regulators have their own reporting requirements, which in many cases are more detailed.

Engineering Estimates

No evidence regarding federal engineering estimates could be found in the sources consulted. However, provincial regulators provide detailed guidance on metering and estimation methodologies. The ECCC provides detailed instructions on how to calculate GHG emissions, including from flares and vents, in its periodically updated guidance.

Record Keeping

According to the Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66 , operators must maintain records that show that they have calibrated monitoring and leak detection devices. Provincial regulators provide detailed guidance on reporting and record-keeping requirements. Regulators may issue penalties for documents containing false or misleading information.

Data Compilation and Publishing

The National Pollutant Release Inventory is Canada’s legislated, publicly accessible inventory of pollutant releases. Its reports are published monthly and annually. Operators must prepare a complete inventory of pollutant release quantities and report emission sources to the National Pollutant Release Inventory if they exceed thresholds. Reporting is mandatory for facilities in the oil and gas sector that meet specified air contaminant threshold criteria. Reports for the previous year are due by June 1 of each year. Provincial energy and environmental regulators often have more detailed reporting on flared volumes and emissions available (see the case studies on Alberta, British Columbia, and Saskatchewan).

Fines, Penalties, and Sanctions

Monetary Penalties

No monetary penalties or fees relate explicitly to gas flaring and venting at the federal level (although provincial regulators can impose them). However, noncompliance with regulations and rules issued by the CER, which include reporting requirements on gas flaring and venting, can result in monetary penalties of up to Can$100,000 (about US$79,000 as of September 2021) a day per violation.

The violation of any specified provision of the Canada Oil and Gas Operations Act, 1999 , or any of its regulations may result in a penalty. Such violations include failure to comply with any term, condition, or requirement of an operating license or authorization or any approval, leave, or exemption granted under the act. Under Paragraph (1)(b), the penalty for a violation should not be more than Can$25,000 (about US$20,000 as of September 2021) for an individual and Can$100,000 (about US$79,000 as of September 2021) for any other entity.

Canada Oil and Gas Operations Administrative Monetary Penalties Regulations (Federal-SOR/2016-25) establish administrative monetary penalties to provide regulatory agencies with an enforcement tool to complement other types of sanctions, such as notices of noncompliance, orders, directions, and prosecution. The process for imposing administrative monetary penalties is similar at both the federal and provincial levels. The CER website provides a record of the sanctions imposed via a downloadable spreadsheet and an interactive tool. Compliance measures reported include administrative monetary penalties and other measures.

The Environmental Enforcement Act, 2010, enhanced the enforcement tools and penalty regime by adding ranges for fines tailored to different offenses. It also introduced minimum fines and increased maximum fines for serious offenses. The Environmental Violations Administrative Monetary Penalties Act, 2009, details environmental administrative monetary penalties.

Nonmonetary Penalties

According to the Canada Oil and Gas Operations Act, 1999 , the CER may suspend or revoke an operating license or an authorization for failure to comply with, contravention of, or default in respect of a fee or charge payable per the regulations made under Section 4 or a requirement undertaken in a declaration referred to in Subsection 5.11.

Enabling Framework

Performance Requirements

No evidence regarding federal performance requirements could be found in the sources consulted. However, provincial regulators provide detailed guidance on the performance of oil and gas operations, including flaring and venting.

Fiscal and Emission Reduction Incentives

Resource owners in Canada (the federal or provincial government, private freehold owners, or First Nations) generate revenues primarily through royalties and taxes paid to them by developers from selling extracted oil and gas. Royalties can be up to 45 percent in federal onshore and offshore fields. No evidence regarding federal fiscal and emission reduction incentives could be found in the sources consulted. However, provinces have fiscal incentive programs, such as royalty waivers to induce gas capture, thereby reducing flaring and venting (see the case studies on Alberta, British Columbia, and Saskatchewan).

Use of Market-Based Principles

In October 2016, the federal government published the Pan-Canadian Approach to Pricing Carbon Pollution, which established the federal benchmark for the 2018–22 period. In December 2016, Canada’s First Ministers adopted the Pan-Canadian Framework on Clean Growth and Climate Change , which required all provinces and territories to implement carbon pollution pricing systems by 2019. Under the federal legislation, the Greenhouse Gas Pollution Pricing Act, 2018, the federal government introduced a two-part carbon pricing scheme: a fuel charge and an output-based pricing system (OBPS). The fuel charge started with a carbon price of Can$10 (about US$7.9 as of September 2021) per tCO2e, increasing to Can$30 (about US$24 as of September 2021) in 2021 and Can$50 (about US$39 as of September 2021) by 2022. The federal benchmark is updated to have an initial carbon price of Can$65 (about US$47.8 as of May 2023) in 2023, and this price is to increase by Can$15 (about US$11) every year to reach Can$170 (about US$125) in 2030 . This price applies in all provinces that do not set their own prices.

The OBPS must be designed to encourage facilities to reduce their emissions. Performance standards must be set such that, at a minimum, the marginal price signal is equivalent to the federal benchmark. Provinces can set their emissions intensity standards. Facilities able to reduce their emissions below these standards are eligible for performance credits. The OBPS “must only apply to sectors that are assessed by the jurisdiction as being at risk of carbon leakage and competitiveness impacts from carbon pollution pricing.” The federal carbon pricing regime does not cover all industries. Methane emissions from the oil and gas value chain, for example, are not comprehensively addressed. Some provinces adopted the federal carbon pricing benchmark or introduced their own carbon tax, while others combined provincial fuel charges with the federal OBPS or vice versa. In all cases, provincial measures must be equivalent to the federal benchmark. Quebec and Nova Scotia have cap-and-trade systems, where the caps must be set consistent with the minimum carbon price.

In 2019, Canada began designing the GHG offset program to encourage the cost-effective reduction of domestic GHG emissions or GHG removal projects from activities not covered by carbon pricing. The government issues offset credits only to projects that produce real, quantified, verified, and unique reductions in GHG. This offset program could provide incentives for upstream oil and gas producers to invest in offset projects.

Negotiated Agreements between the Public and the Private Sector

No evidence regarding negotiated agreements between the public and the private sector could be found in the sources consulted.

Interplay with Midstream and Downstream Regulatory Framework

Market diversity and access are crucial considerations for the Canadian oil and gas industry. The Canadian natural gas market has been fully liberalized since gas prices were deregulated in 1985. Most oil and gas producers rely on pipelines and require provincial and federal policies that allow infrastructure to be built to deliver natural gas to new markets. A license from the appropriate provincial regulator must be obtained to construct and operate a pipeline. The CER, as the federal regulator, has jurisdiction if the pipeline crosses provincial or international boundaries. Federally regulated gas pipelines are generally considered to be contract carriers. The CER sets tariffs and the terms and conditions of access through regulation. The CER has the power to ensure that pipeline tolls are just and reasonable. Access to gas transmission is generally by agreement, but the CER has the power to direct a gas pipeline to provide any available capacity to a third party.

Policy and Targets

Background and the Role of Reductions in Meeting Environmental and Economic Objectives

Alberta is Canada’s largest oil and gas producer. The province accounts for about half of liquid fuel and more than 60 percent of gas production in Canada. Three-quarters of the output comes from the oil sands in northern Alberta. The oil and gas industry emits about half of Alberta’s greenhouse gas (GHG) emissions. The Alberta Energy Regulator (AER) Directive 060: Upstream Petroleum Industry Flaring, Incinerating, and Venting, originally released in 2018 (Directive 060, 2020 hereafter), incorporates recommendations to reduce flaring made by the Clean Air Strategic Alliance (CASA) in 2002, 2004, and 2005.

With the Pan-Canadian Framework on Clean Growth and Climate Change in 2016, Canada committed to reducing methane emissions from the oil and gas sector by 40–45 percent from 2012 levels by 2025. Alberta committed to reducing methane emissions from the oil and gas industry by 45 percent from 2014 levels. Reductions reached 44 percent by the end of 2021 according to the Emissions Reduction and Energy Development Plan released by the Alberta Environment and Protected Areas (formerly known as the Alberta Environment and Parks) in April 2023. The plan says the government “will engage stakeholders, Albertans, and indigenous organizations to assess potential pathways to achieve a provincial 75 to 80 percent methane emission reduction target from the conventional oil and gas sector by 2030 (from 2014 levels).”

In 2018, the Environment and Climate Change Canada (ECCC), a Canadian government agency, published Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector) SOR/2018-66. Provinces can choose to adopt these regulations or draft their own to meet or exceed the stated targets. Section 10 of the Canadian Environmental Protection Act, 1999, authorizes the minister of the environment to defer to “equivalent” regulations promulgated by a provincial government. In 2020, the government of Alberta and the federal government agreed that there were provisions in Alberta Regulation 244/2018, Methane Emission Reductions Regulation equivalent to the federal methane regulations.

To align its directives with the agreement, the Alberta Energy Regulator (AER) issued Bulletin 2020–12: Requirements Aimed at Reducing Methane Emissions Amended, 2020, and made changes to Directive 017: Measurement Requirements for Upstream Oil and Gas Operations, originally released in 2018 (Directive 017, 2018 hereafter), and Directive 060, 2020 . Directive 060, 2020, applies to all operations approved under Section 10 of the Oil Sands Conservation Act, 2000, with the exception of oil sands mining operations, which do not need to flare or vent during bitumen mining.

The Alberta Environment and Protected Areas (formerly known as Alberta Environment and Parks) regulates air quality and is responsible for setting emissions and air quality standards under the Climate Change and Emissions Management Act, 2003. Flaring and venting are subject to gas emission limits and emission offsets to achieve reductions. According to the Emissions Reduction and Energy Development Plan, released in 2023, “Alberta reduced gas flaring and venting volumes by 30 percent and 65 percent, respectively” between 2014 and 2019.

Targets and Limits

Directive 060, 2020 , follows the CASA recommendations, and defines limits on the total annual volume of gas flared, incinerated, and vented at all upstream wells and facilities. If flaring and venting of solution gas exceed the limit in any year, the AER will impose reduction limits for individual operating sites based on analysis of the most recent annual data available.

Section 2.1 of the directive sets an annual solution gas flaring limit of 670 million m³ (50 percent of the 1996 baseline) for the upstream oil and gas industry. As per Section 2.3, the combined flaring and venting volume is limited to no more than 900 m³ a day. Operators must follow the decision tree approach recommended by CASA and demonstrate the economics of conservation options (see sections 12 and 21 of this case study).

According to Section 5.2, for gas plants processing 1 billion cubic meters (m³) of raw gas annually, flaring, incineration, and venting must not exceed 0.2 percent of raw gas receipts or 5 million m³ per year. Limits are slightly higher for smaller processing plants. Acid gas volumes from gas sweetening (which are typically continuously flared) are excluded. As per Section 5.3, gas plants must not conduct more than six major nonroutine flaring events in any consecutive (rolling) six-month period.

The AER does not accept venting as an alternative to flaring or incineration, if gas volumes are sufficient to sustain stable combustion. When venting is the only feasible option, Section 8 of the directive sets an overall vented gas (routine and nonroutine) limit at a site of 15,000 m³ or 9,000 kilograms (kg) of methane a month. The limit on the volume of routinely vented gas at a site is 3,000 m³ or 1,800 kg of methane a month. Section 8.6 prescribes equipment-specific limits on venting.

Facilities that emit more than 100,000 tonnes of GHG a year are required to reduce their emissions intensity by 12 percent under the Climate Change and Emissions Management Amendment Act, 2003.

Legal, Regulatory Framework, and Contractual rights

Primary and Secondary Legislation and Regulation

The Responsible Energy Development Act, 2012, created the AER from the existing Energy Resources Conservation Board. Several laws governing oil and gas activities in the province, including their conservation, lay the foundation for the AER’s regulation of flaring and venting along with the following other acts:

- the Alberta Mines and Minerals Act, 2000

- the Oil and Gas Conservation Act, 2000

- the Gas Resources Preservation Act, 2000 and implementing regulations, Alberta Regulation 151/71: Oil and Gas Conservation Rules, 1971

- Oil Sands Conservation Act, 2000 .

AER Directive 060, 2020 provides comprehensive guidance on flaring and venting. The requirements set forth in the directive are aligned with the Alberta Ambient Air Quality Objectives. Alberta Regulation 244/18: Methane Emission Reductions is an implementing regulation issued under the Environmental Protection and Enhancement Act, 2000. It applies to all upstream oil and gas facilities except processing plants approved under Section 11 of the Oil Sands Conservation Act, 2000.

The Climate Change and Emissions Management Act, 2003 , created the framework for regulators setting limits and pursuing various strategies to reduce emissions. Emissions limits are regulated under the TIER Regulation, 2019 (updated December 2022), which superseded and replaced the Carbon Competitiveness Incentive Regulation, 2018, which replaced the Specified Gas Emitters Regulation, 2007. Companies have three ways to meet their reductions: make operating improvements, buy an Alberta-based credit (see section 22 of this chapter), or contribute to the Climate Change and Emissions Management Fund.

Legislative Jurisdictions

Alberta has jurisdiction over flaring, venting, and incineration, for which the province has comprehensive regulations. Emissions regulations are aligned with federal legislation and regulations.

Associated Gas Ownership

The ownership of oil and gas resources is split between the provincial government, the federal government, private freehold owners, and First Nations. Alberta owns about 80 percent of the mineral rights. The federal government owns 9 percent, including on most Indian reserves and national parks. The remainder is held privately under freehold ownership. The rights to explore for, develop, and produce oil and natural gas, including associated gas, are transferred to participants through licenses.

Regulatory Governance and Organization

Regulatory Authority

The AER is the sole, independent regulator responsible for upstream and midstream oil, gas, and oil sands activities in the province, including flaring and venting. The AER’s governance structure is designed to provide both strong corporate oversight and independent adjudication. The Alberta Environment and Protected Areas regulates the air quality and emissions generated during oil and gas activities.

Regulatory Mandates and Responsibilities

At both the federal and provincial levels, the respective energy regulators have clearly defined responsibilities, with no overlapping or conflicting mandates. Agencies coordinate through collaboration. The AER’s statutory powers, mandates, and functions are governed by the Ministry of Energy, Ministry of Environment and Parks, and Ministry of Indigenous Relations. The AER is responsible for environmental assessments of energy projects; the Alberta Environment and Protected Areas is responsible for environmental assessments of non-energy-resource activities. Environmental approvals are required if any substance that could harm the environment is released. All oil and gas activities receive such approval from the AER.

Monitoring and Enforcement

The enforcement mechanism is outlined in the AER’s Manual 013: Compliance and Enforcement Program, 2020, which ensures a risk-informed approach that balances three compliance components: education, prevention, and enforcement. Numerous tools are available to the AER, including notices, warnings, orders, administrative sanctions, penalties, and prosecution. The Alberta Environment and Protected Areas has similar compliance enforcement tools. It also regularly publishes orders related to noncompliance.

Licensing/Process Approval

Flaring or Venting without Prior Approval

Section 3 of Directive 060, 2020 (“Temporary and Well Test Flaring and Incinerating”; see footnote 1) does not require a permit for unplanned nonroutine flaring and incineration, such as during process upsets and emergencies. In addition, the AER does not require permits for flaring at oil and bitumen batteries. Under certain other conditions (for example, compliance with the percentage of hydrogen sulfide limits or with the Alberta Ambient Air Quality Objectives), permits are not required. These conditions are confirmed by the decision-tree tool adapted from CASA recommendations (Section 3 of AER Directive 060, 2020).

Authorized Flaring or Venting

According to Section 3 of Directive 060, 2020 , planned nonroutine flaring and incineration events require a temporary flaring or incineration permit from the AER, with advanced filing of proper documentation. Section 3 lists the conditions that require a temporary flaring permit and describes the requirements for obtaining the permit. All permit applications are published on the Public Notice of Application webpage. The AER may issue a single “blanket” permit to cover several flaring events at different sites in an area if requested by the licensee. Companies may request a variance from the requirements if they have sufficient justification. Licensees must provide specific engineering, economic, and operational information to justify flaring or incinerating gas volumes above the volume allowance threshold. The AER does not consider venting an acceptable alternative to flaring or incineration (except for inert gases subject to certain requirements; see Section 8.9). It requires that gas be flared if gas volumes are sufficient to sustain stable combustion or conserved.

Development Plans

Directive 056: Energy Development Applications and Schedules, first released in 2021, presents the requirements and procedures for filing a license application to build or operate any petroleum industry on-site installations and the volume that is disposed of by burning in a flare or incinerator. Applicants proposing to flare, incinerate, or vent gas should comply with the requirements of Directive 060, 2020 , and Section 8 of Alberta Regulation 151/71: Oil and Gas Conservation Rules, 1971 .

Since 2018, management of fugitive emissions has been based on a systematic program of detecting and repairing leaks and malfunctioning equipment. The AER requires operators to develop and document a Methane Reduction Retrofit Compliance Plan containing a schedule to replace and retrofit existing equipment and allocating funding to reduce venting. The plan must set an overall limit on the volume of vented gas at all existing and future oil and gas sites by 2023.

Economic Evaluation

Directive 060, 2020, Section 2.9 (Economic Evaluation of Gas Conservation; see footnote 1) requires upstream firms to conduct an economic analysis following the decision-tree framework. Every 12 months, licensees should update the conservation economics for any site that is flaring or venting a combined volume of more than 900 m³ a day. The licensee should keep this information on file and provide it to the AER upon request within five working days. All new and existing flares and vents must be evaluated, except for small intermittent sources (less than 100 m³ a month) in midstream facilities such as processing plants, pipelines, and compressor stations (Sections 4, 5, and 6 of Directive 060).

Alberta has more than 450,000 oil wells of mainly lower productivity and a small number of large oil sands projects. A facility’s individual energy needs will determine the optimal utilization strategy, how much associated gas it produces, and the well’s access to processing and pipeline infrastructure. The break-even economic criteria allow for the recovery of financing costs as well as capital and operating expenses. Conservation options include delivering gas to the market and using it on site as a fuel and for electricity generation and reservoir pressure maintenance. Directive 060 instructs oil, gas, and power generation price forecasts to be used; and asks for details on reserves, capital, and operating cost assumptions. A conservation project is considered economic, and thus requires that the gas be conserved, if the net present value of the project is greater than Can$55,000 (about US$40,400 as of May 2023). In section 21 of this chapter, we discuss how fiscal incentives influence this economic assessment.

Measurement and Reporting

Measurement and Reporting Requirements

Companies must accurately measure and report volumes of associated gas at all oil facilities. Requirements for measuring and reporting volumes of gas flared, incinerated, and vented are provided in Directive 017 and Directive 007: Volumetric and Infrastructure Requirements, and the Oil and Gas Conservation Rules .

For the upstream sector, Section 2.13 of Directive 060 requires flared and vented solution gas to be reported monthly through Petrinex (Canada’s Petroleum Information Network) as per Directive 007. Section 5 of Directive 060 requires separate reporting of all monthly flared and vented volumes at gas processing plants. Flaring of sour gas must also be reported on the S-30 Monthly Gas Processing Plant Sulphur Balance Report.

According to Section 8 of Directive 017, an annual methane emissions report must be submitted electronically to the AER by June 1 of the following calendar year. The first reporting period was 2019. The operator must include the following information in its annual methane emissions report:

- the volume of fugitive emissions by facility

- the corresponding mass of methane emitted by facility

- the type and date of survey

- the number of sources per site per facility.

Measurement Frequency and Methods

According to Section 1.7.2(vi) of Directive 017 , production or processing facilities that have annual average flared and vented volumes above 500 m³ per day must meter continuous and intermittent flared and vented volumes. With heavy oil operations (Section 12.2.2 of Directive 017), “any single stream of produced gas, flared gas, or vented gas volume exceeding 2,000 m³ per day must be metered.” Directive 017 provides details on the standards of accuracy for measurements, calibration of measurement equipment and calculations, and other technical considerations. Referenced documents include the American Petroleum Institute’s Manual of Petroleum Measurement Standards, various standards of the American Gas Association (such as AGA3 and AGA7), and relevant standards of the International Organization for Standardization (such as ISO 5167).

The AER also mandates a fugitive emissions management program that follows the regulator’s survey and equipment guidance. This program should identify preventative maintenance practices; establish procedures for surveying fugitive methane emissions; screen facilities (one or three times a year depending on the type of facility or equipment); conduct training programs; and establish procedures to track, manage, and verify the status of equipment repairs. Equipment releasing fugitive methane emissions must be repaired within 24 hours if the methane emissions cause an off-site odor, the emissions pose a safety risk, or a pilot or ignitor on a flare stack fails. Otherwise, the equipment must be repaired within 30 days, unless the repair requires shutting down the equipment, the emissions have a hydrocarbon concentration of 10,000 parts per million or less, or the source is a surface casing vent flow. The AER will consider innovative and science-based alternatives to the fugitive emissions management program. Alternative programs may incorporate the use of various technologies, such as unmanned aerial vehicles, vehicle-mounted sensors, and continuous monitoring devices to detect, track, repair, and report fugitive emissions (Section 8 of Directive 060; see footnote 1).

Engineering Estimates

According to Directive 017, 2018 , sites with flaring or venting below 500 m³ per day may estimate their volumes. Also, if flaring is infrequent and no measurement equipment is in place, then flare volumes must be estimated. Single-point measurement uncertainty must be ±5.0 percent, and monthly volume uncertainty must not exceed ±20.0 percent. These requirements do not apply to heavy oil and bitumen operations.

According to Section 5 of Directive 060, 2020 , when metering is not mandatory and gas processing plants do not meter flared gas, reporting of any unmeasured flared gas must use engineering estimates.

According to Section 8, methane emissions may be quantified using continuous metering, periodic testing, or estimates based on accepted engineering practices. According to Manual 015: Estimating Methane Emissions, 2020, emissions may be estimated using emission factors, the equations included within the manual, or engineering estimates as described in the Guide for Reporting to the National Pollutant Release Inventory. Any updates in Directive 060, 2020 or Directive 017, 2018, supersedes the guidance in the manual.

Record Keeping

According to Section 10 of Directive 060, 2020 , operators should maintain a log of flaring, incineration, and venting events and respond to public complaints. Logs must include the date, time, duration, gas source or type (e.g., sour gas or acid gas), rates, and volumes for each incident. Records should be kept for at least 12 months. Section 5 of the directive requires gas plant operators to provide documentation for metering or estimating flared and vented gas volumes to the AER upon request. Section 8 requires operators to retain methane emissions records for four years from the date of their creation unless otherwise noted, and provide them to the AER upon request.

Data Compilation and Publishing

The AER regularly publishes comprehensive reports on industry activity at daily, weekly, monthly, annual, and any other relevant frequency. For example, the ST60: Crude Oil and Crude Bitumen Batteries Monthly Flaring, Venting, and Production Data include historical data on crude oil and bitumen production from crude oil and bitumen batteries, and flaring and venting at the batteries by location, type, and operator; they also indicate where the conservation of gas has been economically feasible. The AER also publishes monthly enforcement reports (ST108) and year-end reports (ST60B: Upstream Petroleum Industry Flaring and Venting Report). Reports include flared and vented volumes reported to the AER.

Fines, Penalties, and Sanctions

Monetary Penalties

AER Manual 013: Compliance and Enforcement Program, 2020 , states that flaring, incinerating, and venting audits are required to ensure that flare systems are designed and operated appropriately and in accordance with approved conditions. The manual outlines the various tools available to the AER, including fees and monetary penalties. A schedule of fees can be found in Alberta Regulation 151/71: Oil and Gas Conservation Rules, 1971 .

According to 244/18: Alberta Methane Emission Reductions Regulation, 2018 , an operator that violates venting limits, reporting requirements, or any other obligations imposed by the AER (mainly via Directive 060; see footnote 1) faces a maximum fine of Can$50,000 (about US$39,500 as of September 2021) for an individual and Can$500,000 (about US$395,000 as of September 2021) for a corporation.

The Alberta Administrative Penalty Regulation, 2003, is an implementing regulation of the Environmental Protection and Enhancement Act, 2000 . The maximum administrative penalty that environmental regulators may impose is Can$5,000 (about US$3,950 as of September 2021) for each contravention or each day or part of a day on which the contravention occurs and continues.

Nonmonetary Penalties

Alberta’s legislation includes rising levels of sanctions depending on the seriousness of the violation, including production shut-in or suspension of application processing. Section 25 of the Oil and Gas Conservation Act, 2000 , authorizes the AER to cancel or suspend a license or approval for a definite or indefinite period. In particular, the AER may suspend well flaring permits for noncompliance. The AER’s decisions may be appealed under Section 36 of the Responsible Energy Development Act, 2012 .

The AER Compliance Dashboard provides a compliance history of companies since 2014. The dashboard is searchable. Between 2015 and March 2023, it recorded 58 flaring violations. The AER handled almost all of them via notices of noncompliance or site inspections, but it also imposed administrative penalties in a few cases. Facilities may be shut if operators do not take corrective actions to comply with AER instructions within the time provided.

Enabling Framework

Performance Requirements

Section 7 of Directive 060, 2020 details performance requirements such as conversion efficiency, smoke emissions, ignition, and stack design for flaring and venting. They apply to flares and incinerators—including portable equipment used for temporary operations—in all upstream oil and gas industry systems for combusting sweet, sour, and acid gas during activities that include well completion, servicing, and testing.

The AER has adopted CASA’s objective hierarchy and decision-tree framework for managing solution gas volumes and extended its application of the hierarchy to include flaring, incineration, and venting. The goal is to eliminate routine flaring, incineration, and venting. The objective hierarchy ranges from eliminating routine flaring, incineration, and venting of unburned gases to reducing the volume of such gas and improving the efficiency of the related systems.

Fiscal and Emission Reduction Incentives

In 1998, the government of Alberta announced the Otherwise Flared Solution Gas Royalty Waiver Program. Flaring gas that could be economically conserved makes the gas ineligible for a royalty waiver. The waiver is independent of the end-use of the gas and lasts for 10 years. Companies are also exempt from royalties if gas is used for on-site power generation. The gas royalty rate is 5 percent during the cost-recovery period, after which the royalty rate is a function of the reference gas price and production level.

According to Directive 060, 2020 , gas conservation economics should account for royalties paid for incremental gas that would otherwise be flared or vented. If the economic evaluation results in a net present value of less than Can$55,000 (about US$40,400 as of May 2023), the operator should reevaluate the gas conservation project on a before-royalty basis. If the evaluation results in a net present value of Can$55,000 or more, the operator should proceed with the conservation project and apply to the AER for an “otherwise flared solution gas” royalty waiver.

Use of Market-Based Principles

Alberta put a price on carbon emissions for large industrial emitters in 2007. It put a carbon levy on fuel from 2017 until its repeal in 2019. In December 2019, Alberta passed Bill 19, the Technology Innovation and Emissions Reduction Implementation Act, which laid the foundation of the market-based Technology Innovation and Emissions Reduction (TIER) system to induce industries to reduce emissions. Facilities that voluntarily reduce emissions may qualify for offsets or performance credits under the Alberta Emission Offset System.

In 2019, the original TIER Regulation set a price of Can$30 (about US$24 as of September 2021) per tCO2e on emissions from the oil and gas, electricity, cement, agriculture, and other sectors. The benchmark price rises to Can$40 (about US$32 as of September 2021) per tCO2e in 2021 and Can$50 (about US$39 as of September 2021) per tCO2e in 2022. This regulation meets the federal criteria.

In the past, the carbon price applied to facilities that had emitted 100,000 tCO2e or more a year in 2016 or subsequent years. An amendment in July 2020 allowed facilities that emit between 10,000 and 100,000 tCO2e to voluntarily comply with the regulation, or opt in, and reduce the administrative burden for regulated conventional oil and gas facilities in exchange for an exemption from Canada’s federal carbon price (see section 22 in the preceding case study). Also, firms are offering a lease-to-own program for nonemitting facility equipment. This program allows companies to voluntarily reduce emissions and generate carbon credits to pay down equipment leases.

To align with the federal changes discussed in section 22 of the preceding case study, the TIER Regulation was updated at the end of 2022 . Carbon prices will match federal prices set for the 2023–30 period. The opt-in threshold is lowered from 10,000 to 2,000 tCO2e per year, enabling smaller firms to participate in the offset market. Amended regulations introduce two new credit classes: sequestration credits and capture recognition tonnes. Companies can convert the emissions offsets associated with a sequestration project to sequestration credits, which follow the same rules governing banking, trading, and compliance. Companies can convert sequestration credits to capture recognition tonnes, which must be used in the year of capture.

Amended regulations increased credit use limits (“true-up obligation”—the quantity by which a regulated facility’s total regulated emissions exceed its permissible emissions for the year) to 90 percent by 2026. Since offsets and credits can be used only once by their owner, the higher percentage is expected to encourage the earlier retirement of more offsets and credits and, thus, investment in new emission reduction activities.

Also, the TIER system now includes emissions from flaring. The flaring reduction target is set at 10 percent for 2023, with further reductions of 2 percent annually. Venting and fugitive emissions are not considered.

Negotiated Agreements between the Public and the Private Sector

The AER allows flaring when conducted in accordance with Directive 060, 2020 . However, an applicant for drilling and the landowner or land occupant may sign a zero-flaring agreement and file it along with the well application (Section 3.10). Once filed, the agreement becomes a condition of the well license. Should the licensee, operator, or approval holder fail to adhere to this agreement, operations at the well may be suspended. This agreement, including the condition, expires when production begins.

Interplay with Midstream and Downstream Regulatory Framework

AER regulations on flaring, venting, and emissions cover pipeline and storage facilities. Most oil and gas produced in Alberta is exported to other provinces or the United States via pipelines. Occasionally, an imbalance between demand and supply, bottlenecks in pipelines, or permitting delays can affect upstream operations. In 2018, for example, western Canadian oil supply outgrew the export pipeline capacity, resulting in record crude price differentials. Alberta’s government mandated a production curtailment effective January 2019, later extended to December 31, 2020. Such a curtailment would likely reduce emissions from associated gas flaring but only temporarily.